Liquidity pools are an innovative solution within DeFi to create the mechanics of a market maker in a decentralised fashion. Although often met with confusion, they are simply clusters of tokens with pre-determined weights.

A token’s weight is how much its value accounts for the total value within the pool. Liquidity Pools are an exciting and equalising tool, which represent the true nature of the Decentralised Finance (DeFi) and Web3.0 movement.

This blog will offer some insight into Liquidity Pools.

It will first take you through what they are and why they exist, followed by how they work to create an environment, which incentivises contribution. It will then explore some suggestions as to why you may be interested in engaging with them and finally how to get involved.

What is a liquidity pool?

In a previous blog post we outlined where liquidity pools derived from which we’d recommend you read here first if you haven’t already.

At a high level, liquidity pools are a method of increasing liquidity, similar to the way traditional exchanges use market makers.

Yet, where traditional finance requires expensive and centralised intermediaries, which have a level of power to manipulate prices, liquidity pools offer a decentralised alternative through automated market makers, which offer a unique opportunity for anybody to contribute to a pool which behaves similar to a market maker. The pool is essentially a shared market maker, the gains from which are distributed between those that contribute.

This both embodies the ideals of blockchain and decentralisation generally and offers users and companies unique opportunities to trade more efficiently and cheaply whilst having total trust in the system makes it so. Before they arrived on the scene, liquidity, i.e. how easy it is for one asset to be converted into another, often fiat currency without affecting its market price, was difficult for DEXs.

How do they work?

In order for Liquidity Pools to function in the way that leads to the outcomes laid out above, i.e. greater decentralisation of projects and increasing liquidity, there are a number of key aspects worth understanding:

- token weighting;

- pricing;

- market-making functions;

- LP tokens.

(much of the following is taken from the official documentation from Osmosis Labs).

Token weight

Liquidity pools are simply clusters of tokens with pre-determined weights. A token’s weight is how much its value accounts for the total value within the pool.

For example, Uniswap pools involve two tokens with 50–50 weights. The total value of Asset A must remain equal to the total value of Asset B. Other token weights are possible, such as 90–10.

Pricing

With fixed predetermined token weights, it is possible for AMMs to achieve deterministic pricing, i.e. outcomes are precisely determined through known relationships among states and events, without any room for random variation. As a result, tokens in LPs maintain their value relative to one another, even as the number of tokens within the pool changes. Prices adjust so that the relative value between tokens remains equal.

For example, in a pool with 50–50 weights between Asset A and Asset B, a large buy of Asset A results in fewer Asset A tokens in the pool. There are now more Asset B tokens in the pool than before. The price of Asset A increases so that the remaining Asset A tokens remain equal in value to the total number of Asset B tokens in the pool.

Consequently, the cost of each trade is based on how much it disrupts the ratio of assets within the pool. Traders prefer deep liquid pools because each order tends to involve only a small percentage of assets within the pool. In small pools, a single order can cause dramatic price swings; it is much more difficult to purchase say 1,000 ATOMs from a liquidity pool with 2,000 ATOMs than a pool with 2,000,000 ATOMs.

Market-Making Functions

AMMs leverage a formula that decides how assets will be priced in the pool. Many AMMs utilise the Constant Product Market Maker model (x * y = k). This design requires that the total amount of liquidity (k) within the pool remains constant. Liquidity equals the total value of Asset A (x) multiplied by the value of Asset B (y).

Other market-making functions also exist, you can find out more about these here.

Liquidity Pool Tokens (LP tokens)

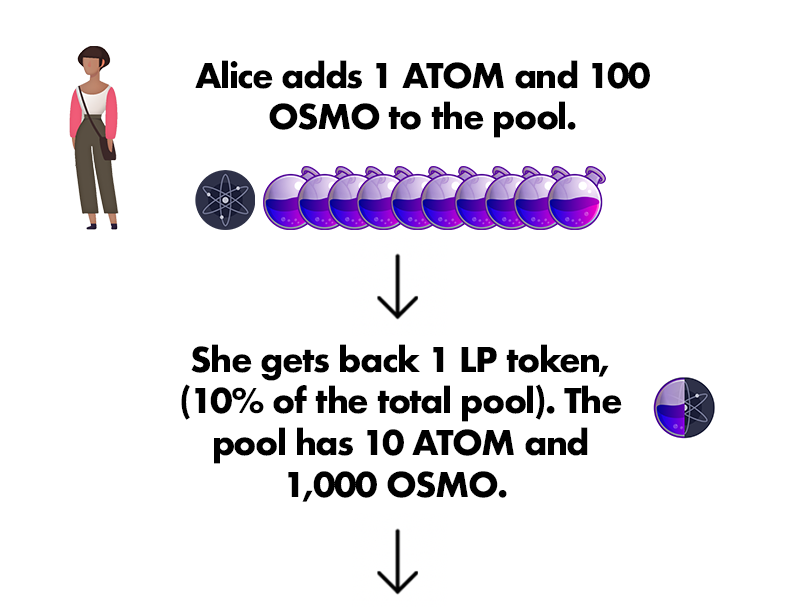

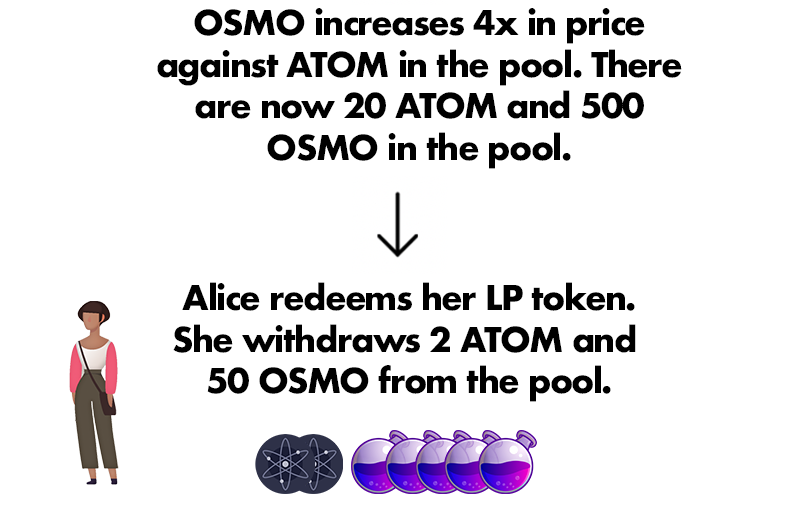

When a user deposits assets into a Liquidity Pool, they receive LP tokens. These represent their share of the total pool.

For example, if Pool #1 is the OSMO<>ATOM pool, users can deposit OSMO and ATOM tokens into the pool and receive back Pool1 share tokens. These tokens do not correspond to an exact quantity of tokens, but rather the proportional ownership of the pool. When users remove their liquidity from the pool, they get back the percentage of liquidity that their LP tokens represent.

Source: Osmosis Labs docs

Why should I care?

The collection of the mechanisms above is used to ensure liquidity pools are able to maintain a stable price and ultimately work as a traditional market maker would do.

However, in order to achieve their ultimate goals, encouraging token holders to provide liquidity to pools is required.

The aspects in place to do so is what is known as ‘liquidity mining’ or ‘yield farming’. Contributing to a pool makes an individual a liquidity provider (LPs).

Liquidity mining

Liquidity providers earn through fees and special pool rewards. LP rewards come from swaps that occur in the pool and are distributed among the LPs in proportion to their shares of the pool’s total liquidity. So where do the rewards themselves come from?

Liquidity rewards are derived from the parameters laid out in the genesis of the AMM, in the case of the Cosmos Ecosystem this is Osmosis. For Osmosis, each day, 45% of released tokens go towards liquidity mining incentives.

When a liquidity provider bonds their tokens they become eligible for the OSMO rewards. On top of this, the Osmosis community decides on the allocation of rewards to a specific bonded liquidity gauge through a governance vote.

Bonded Liquidity Gauges

Bonded Liquidity Gauges are mechanisms for distributing liquidity incentives to LP tokens that have been bonded for a minimum amount of time. For instance, a Pool 1 LP share, 1-week gauge would distribute rewards to users who have bonded Pool1 LP tokens for one week or longer. The amount that each user receives is in proportion to the number of their bonded tokens.

The rewards earned from liquidity mining are not subject to unbonding. Rewards are liquid and transferable immediately. Only the principal bonded shares are subject to the unbonding period.

However, as with any opportunity for gain, there is of course some degree of risk; i.e. an individual could be better off holding the tokens rather than supplying them.

This outcome is called impermanent loss and essentially describes the difference in net worth between HODLing and LPing (more here). Liquidity mining mentioned above helps to offset impermanent loss for LPs. There are also other initiatives within the Osmosis ecosystem and beyond exploring other mechanisms to reduce impairment loss.

How do I get involved in liquidity pools

So you’re sold on their potential and now you want to get involved?

Liquidity pools can be access across DeFi, whether in the Ethereum ecosystem using UniSwap and SushiSwap, or closer to home for cheqd in Cosmos, through Osmosis and Emeris.

For the purpose of this article we’ll share how to get involved using Osmosis.

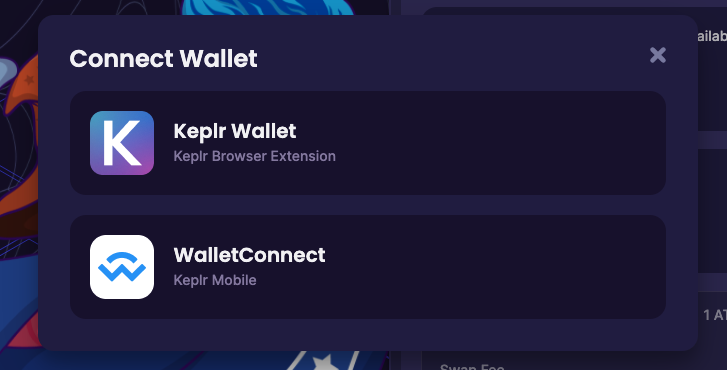

First, head to Osmosis and click enter the lab. Once you’ve agreed to terms and you’re ‘in the lab’ you’ll see some trading pairs and a button to connect your wallet (bottom left of the dashboard).

You can then select Keplr wallet which will automatically connect to your Keplr wallet if you’ve already set it up as a Browser extension.

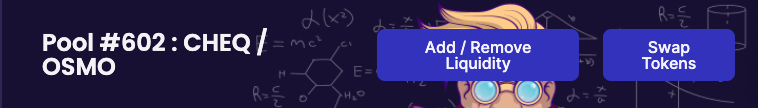

Next, you’ll need to deposit the assets you would like to contribute towards a Liquidity Pool. You can see the available Liquidity Pools under ‘Pools’. For example, if you would like to contribute to the Pool #602 : CHEQ / OSMO, you will need to deposit both of these tokens.

To do so, select ‘Assets’ and find the tokens you would like to deposit to contribute to the pool.

Note: if you already hold OSMO in your Keplr wallet you won’t be required to deposit.

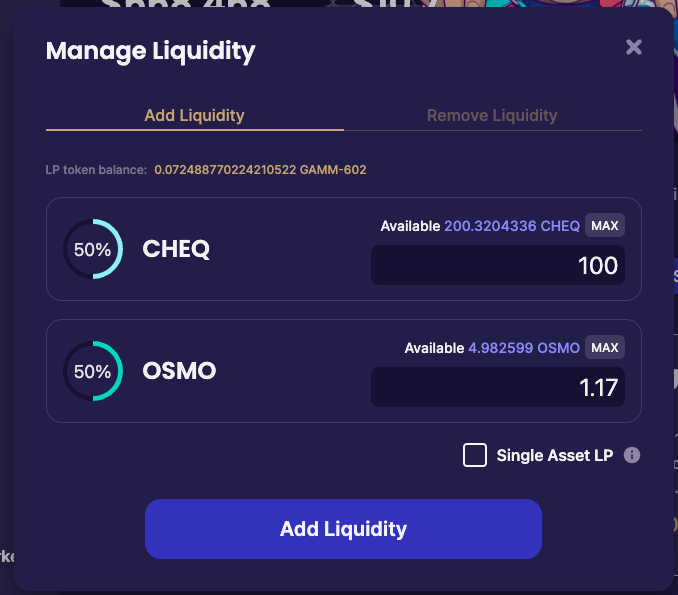

Once you have deposited enough tokens for both sides of the pools (i.e. ensure that if the pool is setup as 50:50, you must have the equivalent amount is USD on both sides)

Next, find your pool and select ‘Add/ Remove Liquidity’.

Here you’ll be able to add tokens on both sides of the pool.

On selecting ‘Add Liquidity’ you’ll then be directed back to Keplr to approve the transaction (a small fee is required).

Once you have added liquidity to the pool, you’ll receive your LP tokens (a token representing your share of the total pool). Now it’s time to start ‘Liquidity Mining’.

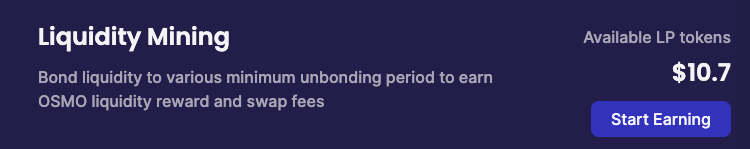

You’ll now be able to see your total Available LP tokens. Below this you’ll see an option to ‘Start Earning’.

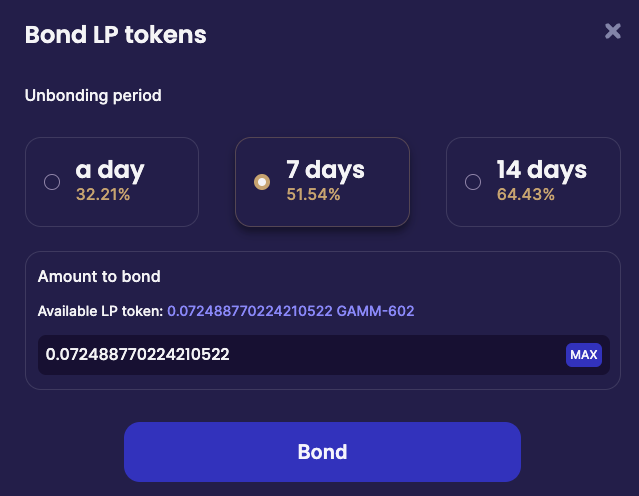

Once here you’ll see a few options for your unbonding period (i.e. the amount of days it takes to remove your tokens from the pool if you decide to withdraw). The longer you choose to bond your tokens, the higher the rewards you’ll be eligible to earn.

Next select the amount of your LP tokens you’d like to contribute to the pool and finally hit ‘Bond’ (this will kick off another approval through a Keplr pop-up).

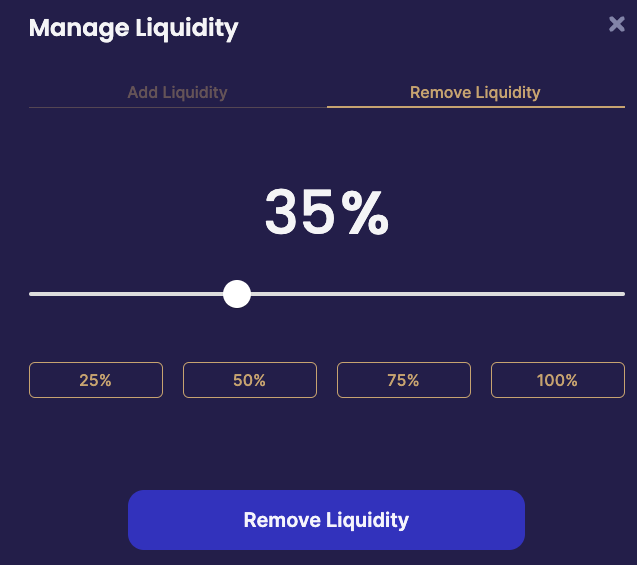

You’ll now see your total bonded tokens. Each day rewards will then be distributed. When you decide to withdraw from the pool you’ll simply need to select ‘Remove Liquidity’ and select the amount you’d like to withdraw.

Conclusion

Overall, liquidity pools offer a new avenue for projects to gain more liquidity, and believers of these to show their support. Where for many years engaging in and benefiting from such financial systems was reserved solely for the wealthiest individuals and large organisations, now anyone can gain access and start contributing to their favourite projects, voting on their future direction and earning from the part they play.

Note: for the purpose of engaging with cheqd through its token the information above is not required, however, we strongly believe in the value of educating and sharing what we’re learning with our community to help you better understand DeFi and support us in raising the awareness of the shift to Web 3.0.