TL;DR — The Agentic Economy

AI or personalised agents have been spoken about for years in Self-Sovereign Identity (SSI) and Decentralised Identity (DID) circles, they are imminent and will have a colossal impact on user and consumer experience. In the agentic economy, AI agents will be used to cast intents out into marketplaces (whether DeFi, travel or other) and negotiate on behalf of individuals. This will allow the creation of personalised travel itineraries, including with the use of loyalty schemes, or identifying and negotiating the best offers for a desired product or service as an example.

All of these new experiences require access to trusted data, such as loyalty schemes, insurance policies, identity data, and more to fulfil these services. To access this data, agents will need to either directly pay or provide value back to whichever organisation provides it.

The agentic economy will be powered by the trusted data economy.

cheqd and $CHEQ stands ready to power the agentic economy, ensuring AI/personalised agents have access to the data required to successfully and accurately execute their user’s intents, creating this new user experience paradigm.

Furthermore, AI agents add an additional multiplier into $CHEQ tokenomics as well as accelerating the velocity and frequency of use of credentials.

- Data subject x number of AI agents per subject x number of organisations issuing data x number of organisations receiving data x number of credentials

Verifiable AI is key to further accelerate the agentic economy by ensuring that the Trusted Data AI agents rely on is accurate.

AI / Virtual / Personalised / Smart Agents — Verifiable AI

Whatever you call them, they’re coming… …to work on your behalf.

AI agents follow the definition of a legal agent, below, simply shifting from being a person as in the historic definition to AI.

“A person who has been legally empowered to act on behalf of another person or an entity”

Smart agents, synonymous with AI agents, have long been on the roadmap for decentralised identity / Self-Sovereign Identity to counteract, simplify and generally improve the efficiency of individuals having to deal with a deluge of personal data and hence decisions on what they’re receiving and what they are sharing. In the current ownership these decisions are delegated to centralised platforms / siloes that can resell / share personal data without visibility of the individual. Agents are envisioned to play a critical role in managing the interactions, data, and credentials involved in SSI systems.

DID / SSI Terminology

It is worth clarifying some terminology within DID / SSI which can be confusing:

- User agents: Software applications that allow users to manage their credentials (e.g. wallet apps).

- Edge agents: Software usually on personal devices such as smartphones or computers, typically to allow individuals to manage credentials. Conceptually extremely similar to “User agents” with the additional specification of the compute resource it is stored to.

- Enterprise agents: Software used by organisations to interact with or manage credentials.

- Cloud agents: Software in data-centres or the cloud which allow organisations or individuals to interact with or manage credentials. Typically similar to “Enterprise agents” with the additional specification of the compute resource it is stored to although can sometimes refer to “User agents” operating from the cloud / data centres.

We’ll be focusing on “User agents” since innovation here will have by far the greatest impact in terms of user experience and changing the paradigm of the interaction between people and companies.

Basic functionality

Agents were always envisioned as helping people manage their data, privacy, ownership, and consent with the shift to a data-control/ownership paradigm where they are in charge. They would also help negotiate interoperability, as this problem is solved, navigating between different credential formats and exchange protocols, meaning users would never need to worry whether their driving licence is mDL or SD-JWT format.

Crypto Agents & Intents

As with SSI / DID, agents are being touted as the silver bullet to help users navigate the complexities of crypto, especially DeFi with a myriad of protocols and networks. Hence token representations requiring intelligent bridging between protocols and networks to achieve desired outcomes.

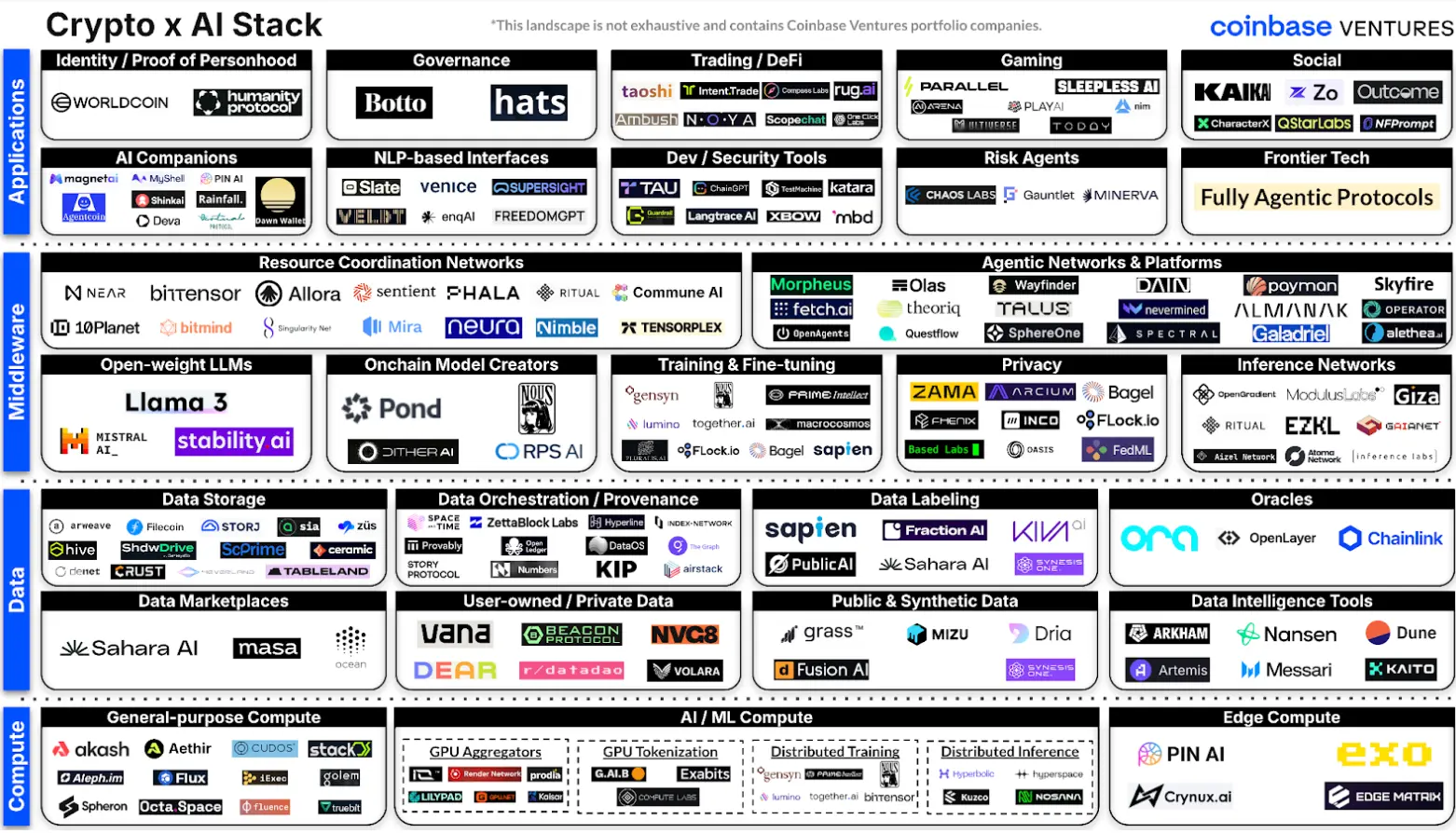

Coinbase, for example, has identified 18 companies building “agentic networks & platforms” within or adjacent to Web3 / crypto. They have also revealed a core thesis surrounding the “agentic web”.

Similarly, Binance recently released a report on the “Future of AI agents in crypto”. A key concept adjacent to the “agentic” internet is “intents”, defined by Coindesk below.

… an intent is a specific goal a blockchain user wants to accomplish…

Could AI agents become the next big players in crypto markets?

Our latest #Binance research report dives into the convergence between AI agents and crypto, discussing its origins, major projects, challenges, and future implications.

Check it out ⬇️https://t.co/9MgUdjmoD4— Binance Research (@BinanceResearch) November 12, 2024

“Intent”-centric architectures are necessary since:

“blockchains are expanding so rapidly. With Bitcoin, Ethereum, a host of alternative layer-1 networks, layer-2 networks, and now even layer-3 networks proliferating, accompanied by myriad “bridges” and other “interoperability” solutions connecting them all, it’s all becoming more daunting to navigate.

“the number of possibilities that you can do on blockchains has compounded,” Arjun Bhuptani of Connext, an interoperability protocol, explained. “You have an infinite possible way of doing a transaction at a given time.”

Beyond Crypto / Web3: Intent-Casting

This limitation to blockchains is exactly that, limiting and unnecessarily so. OpenAI for example is intending to release AI agents which can automate tasks for individuals. Beyond simple automation, a more interesting and revolutionary idea is intent-casting

“A way of issuing a personal “Request for Proposal”, a buyer-initiated procurement protocol typically used by businesses, governments and other large organisations” where multiple companies provide quotes which the buyer then selects from depending on budget, whether the proposal meets the request and personal preference.

Examples could be:

- “I need to rent a minivan that seats six and has a roof rack in Salt Lake City next week.”

- “Here’s a QR/barcode/photo of the boots I want in size 9E. Who can get them for me by tomorrow — without knowing yet who I am, while also knowing that I’m for real?”

- “I need to exchange 1 BTC for DOGE with the best available rate, and have it settled on chain in under 10 minutes.”

- “I’m looking for a liquidity pool on Uniswap that maximises my yield for a 3 month stake, without too much impermanent loss risk.”

- “Find me a DAO to join that aligns with my interests in DeFi yield farming, and has the most active community of contributors.”

Intent-casting effectively inverts the current consumer-company paradigm in a way that comparison websites and general product search attempt to a small degree. Instead of having to search and then compare products which may be similar but are fundamentally different and then compare across vendors, intent-casting brings all the relevant products or services to you, ranks them in terms of your stated preferences and allows you to select the offer which suits you best extremely quickly with much less cognitive effort.

Personalised AI

To achieve “intent-casting”, AI or smart agents need access to accurate and verified personal data to make informed decisions on an individual’s behalf. Otherwise the request to the market could be wildly inaccurate, misleading or downright dangerous, for example:

- Low risk: receiving a range of product options all of which aren’t suitable because the wrong preference was shared, e.g. colour or size.

- High risk: broadcasting your genuine address, salary and house contents to an entire marketplace due to a lack of privacy controls.

User-owned / private data is therefore crucial for “agentic networks & platforms”. The more accurate data an agent has about an individual the better results it will secure, prioritise and present.

Examples

Cookies

Imagine a world where those annoying cookie pop-ups and consent prompts are a thing of the past because your personal AI agent has already taken care of them for you. Every time you surf the interwebs, you move seamlessly from page to page, while your trustworthy agent silently manages these interruptions in the background.

Travel

Now picture something even more exciting. Say you’re planning a holiday. Your agent analyses all your previous trips — those flowery escapes you loved, those overly busy tourist traps you didn’t — and combines that insight with your new preferences, your dream destination, and your budget. The result? A complete itinerary, thoughtfully crafted to fit your tastes and lifestyle. And here comes the game changer: your agent books everything on your behalf, handling flights, hotels, travel insurance, and more. All you need to do is pack and thank verifiable credentials.

eCommerce & Insurance

Another example, imagine shopping for something a bit pricier online, like a new laptop or a high-end TV. Your agent doesn’t just search; it sends out your specs and preferences to trusted retailers, gathering tailored offers based on the best fit for you. Then, by securely verifying that you’re a genuine customer, it unlocks special discounts, saving you money while protecting the retailer from risks like chargebacks or scammy returns.

Once you decide on a purchase, your agent automatically saves the receipt somewhere safe (no more scouring inboxes to find it later), and even contacts your insurance provider to make sure your new item is covered. If it’s already covered, your agent confirms it’s included; if not, it lets you know about any extra costs, seeking your consent for coverage.

In short, this agent takes the grind out of everyday logistics, from browsing online to planning adventures — giving you back your time and peace of mind.

The Agentic Economy

Agents require access to accurate and current personal data to appropriately serve requests by their users and ensure the agentic economy thrives. Some data can be provided by users, such as email or conversation history which can help provide personality and tone for agent’s communications when representing individuals but other data will require veracity, provenance and lineage.

For example, where an agent is arranging travel or overall trip, the ability to access and use loyalty programmes to achieve discounts is crucial and relies on agreement with the loyalty programme provider. Similarly, any insurer will want proof that a receipt is from the correct retailer due to fraud concerns and therefore the agent needs to be able to manage trusted data / verifiable credentials to negotiate these use-cases and more.

As with the trusted data economy, all of this data has value and hence companies will expect to be paid whenever that value is used . This will require agents to acquire trusted data wherever possible and negotiate data value chains to secure said data.

Similarly to “intents” with regards to blockchain networks, agents will be responsible for obtaining data or trusted data at the lowest price point wherever the data can be sourced from multiple places.

For example if a service required a credit score or file but it can come from any reputable provider, the agent can source either:

- The highest credit score so the user can secure the best offer, or

- If all their credit scores are above the threshold, optimise for the cheapest cost to the user if required.

$CHEQ

cheqd tokenomics and hence burns of $CHEQ through network utility usage have always scaled with the volume and velocity of trusted data. The agentic economy introduces a new factor / multiplier into this equation.

Previously, usage of network utilities would scale by number of people, organisations or things, looking to share data with other organisations or people:

- Data subject x number of organisations issuing data x number of organisations receiving data x number of credentials

With agents added in, that becomes:

- Data subject x number of AI agents per subject x number of organisations issuing data x number of organisations receiving data x number of credentials

There will also be an increased frequency and velocity of sharing as a result. It’s also feasible that each agent will not only have a DID on the network but will also be represented on trust registries to demonstrate publicly that they have been verified. As mentioned above, OpenAI intends to release AI agents to help automate tasks imminently. However, it is then crucial for these agents to prove they both have the appropriate authorisation and were created by reputable companies to avoid colossal issues with fraud and impersonation.

As an illustration of the scale of the impact agents will have.

There are ~8.1b people on earth; if even 1/10th of them have a singular agent, there would be 0.8bn agents. In practice, people are likely to have multiple agents, as will organisations and even potentially things meaning the numbers are astronomical. Each of these agents, whether for individuals, companies or things will all be transacting trusted data.

Conclusion

We believe that agents are here to stay and that it will kickstart a new economy. Together with our partners such as Timpi, Devolved AI, Nymlab, and others, we’re building solutions that will add trust, convenience and safety to mundane, or not, tasks we perform every day.

Trust will come from credentials and other SSI technologies and frameworks that are intrinsic to the cheqd network. Payments are central to any economy and cheqd is well positioned with $CHEQ and credential payments to play a key role in the new Agentic economy.

If you’re interested in growing the Agentic Economy together with us, please get in touch at [email protected].