cheqd studio is an API service to easily build trust and payments for digital credential ecosystems.

We are excited to announce that our API product, cheqd Studio, is transforming into a more refined product: cheqd Studio. This shift recentres the focus of the product around providing two core concepts: trust infrastructure, including DIDs, Trust Registries and Status Lists; and payment infrastructure, including verifier-pays-issuer with USDC and EUROe support. These concepts are at the heart of cheqd’s core Network functionality, enabling us to fully productise and double-down on our original hypotheses for cheqd.

Why did we choose to evolve to Studio

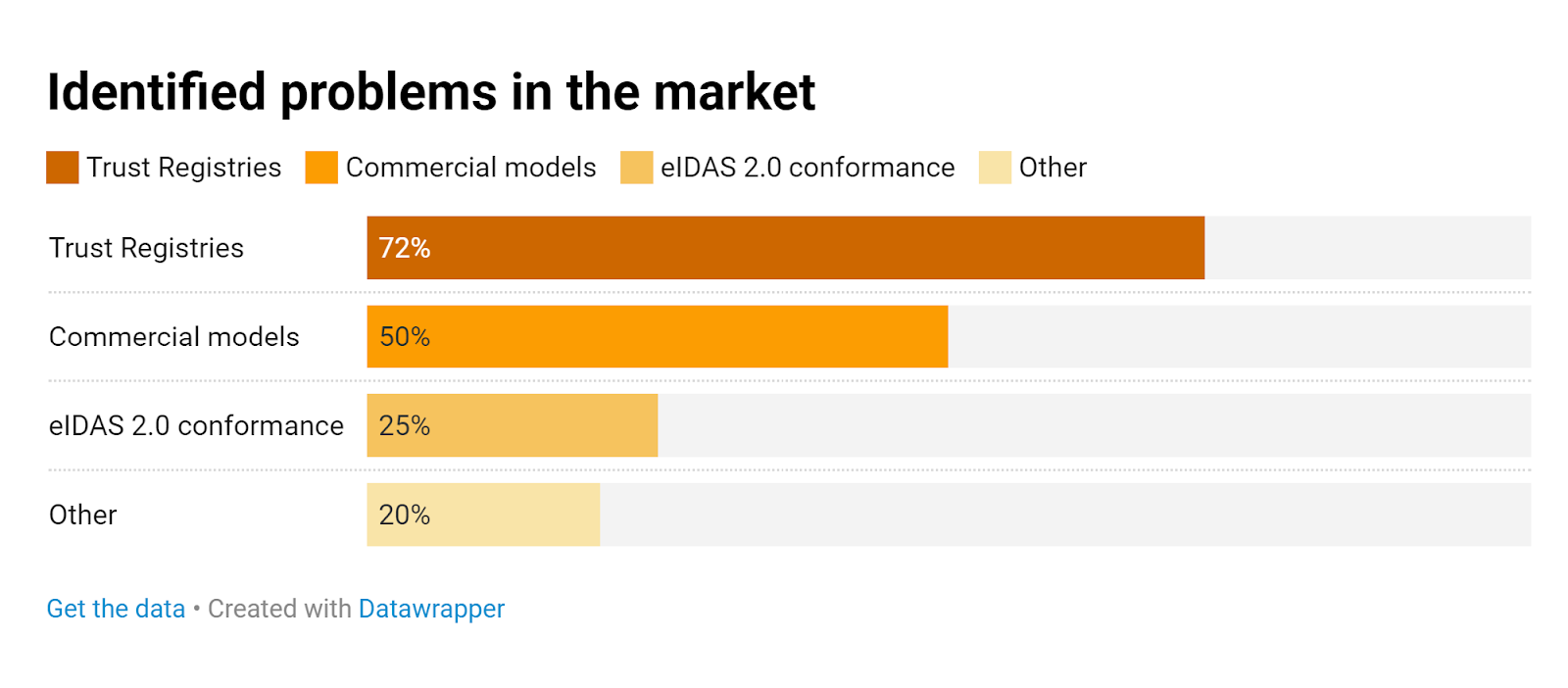

Over the previous three months we ran a series of product interviews with leading digital credential companies and experts to determine the problems that they and their clients are facing.

This product-led research helped us re-establish what our partners and clients want from cheqd. In this research phase, we established two clear problems in the market:

92% identified either (1) Trust Registries; or (2) Commercial models for credential ecosystems as being a blocker in their projects or clients reaching production environments.

This was a significant validation for our functionality we have built on the cheqd Network, and reinforced our previous hypotheses about building at the network layer, given that providers high up the tech stack have not been able to solve these challenges on their own. We therefore have decided to rename the product from “cheqd Studio”, which suggested that the unique selling point of the product is centred around “credentials”, to cheqd Studio, which reinforces that the selling point for the product is around “cheqd”, and the innovative offerings it can provide. With the renaming of the product, the available APIs will also focus more prevalently on solving two crucial problems for the industry: establishing trust infrastructure to empower relying parties to fully trust the credentials they receive; and, facilitating payment infrastructure to allow companies and consortia to establish commercial models for credential flows, with stablecoin support and fiat on-ramping and off-ramping.

Trust Infrastructure

Historically there has been a challenge for most ecosystems that utilise Decentralised Identifiers (DIDs), whereby a Relying Party could establish that a DID is legitimate, but they couldn’t establish that a DID actually belongs to the entity attesting to control the DID.

This is because DIDs are “decentralised” and therefore are not intrinsically backed by any centralised authority. For this reason, DIDs need to operate within a “trust infrastructure”, where a Relying Party can verify the legitimacy of a DID, by ascertaining that a DID was accredited or authorised by another entity; and, that the “Root of Trust” entity is who they claim to be. This trust can be achieved in multiple ways:

- Decentralised: Resolving back to an identifier which is verifiably more reputable than others, through mechanisms such as proof of work, stake or authority.

- Federated: Resolving back to an entity which is trusted within a known and trusted federation or scheme.

- Centralised: Resolving back to a central authority root of trust such as a DNS domain or an X.509 certificate backed by a Certificate Authority;

cheqd provides a flexible trust infrastructure solution that can be extended to any Root of Trust model, including traditional X.509 certificates (centralised), OpenID Federation (federated), Fraunhofer Institute’s TRAIN (federated) or full decentralised reputation (decentralised). cheqd’s trust infrastructure uses DIDs as the entity identifiers, and allows any signed data format (e.g. JWTs or Verifiable Credentials) written as a DID-Linked Resource to be used for accreditations between parties.

This creates a flexible infrastructure for governing authorities to create hierarchical trust chains, offering support for the EBSI Trust Chain model or OpenID Federation. Owing to these capabilities, cheqd’s trust infrastructure is also directly compatible with the Trust over IP Trust Registry Protocol Specification, enabling relying parties to easily query whether an entity is accredited for a particular purpose, under a governance framework.

The benefit of using this trust infrastructure on cheqd, as opposed to using did:web, did:tdw or traditional web domains is the ability to persistently store chronological versions of trust registry entries which can be retrieved with full historical provenance and immutability. This provides far more “trust” in the integrity of the data and greatly minimises risk of tampering or server outages. Moreover, cheqd can be combined with other infrastructure for providing “Roots of Trust”, such as X.509 Certificate Trust Chains, DNS, KERI or more decentralised reputation systems to create full end-to-end trust registries across multiple ecosystems. To further scale this approach, we are also working with the European Blockchain Sandbox to establish a standardised approach for the European market to trust registries, with a common “universal” approach, like the Universal Resolver and Registrar.

Payment Infrastructure

Towards the end of 2023, cheqd launched its first-of-its-kind Credential Payments model, offering encrypted DID-Linked Resources with payment conditions to unlock, to facilitate Verifier-pays-Issuer commercial models for credentials.

Now, within cheqd Studio, we are looking to supercharge Credential Payments, for use within regulated industries and existing data sharing consortia. In order to get to production environments across this sector, we have decided to provide the following functionality:

- Stablecoin support: via USDC and likely EUROe, EURC and other desired currencies for making credential payments and using cheqd functionality

- Commercial models for consortia or schemes: creating guides on establishing commercial models for consortium or scheme operators and participants to exchange payments for verifiable credentials within the scope of Markets in Crypto Assets Regulation (MiCA) Regulation, with clear liability and governance structures.

Doubling down on Credential Payments has been a decision that we are proud of as a team, reinforcing the core cheqd hypotheses from the company’s inception. And these next developments will take the product into a state of maturity to provide the backbone for establishing large trusted data markets, supporting the continual demand for commercial models for verifiable credentials.

It is also important to explain that stablecoin support on cheqd will complement the CHEQ token and provide it greater utility. For example, USDC is supported on Cosmos through Noble, and as such, we will be able to leverage Cosmos’ concept of “fee abstraction” to settle transactions and fees in USDC on the cheqd Network, where under the hood, USDC and CHEQ are being exchanged on-the-fly to utilise the network’s core identity functionality. In addition we’re currently implementing an EIP1559-style burn mechanism to burn $CHEQ tokens when any currency is used on the network, whether USDC or other.

This provides adopters the security and comfort of making transactions in a stable currency, while also offering benefits of blockchain technology that would not be possible with traditional payment rails or more centralised technology choices. For example, cheqd’s credential payments enables: non-repudiation and transaction finality; decentralised payment-gating with no risk of surveillance; privacy preserving flows for credential holders with no “phone home” correlation risk; and, smart contract-style logic for ensuring payments are made and settled.

Powerful Partnerships

With cheqd Studio, we will be working even more closely with our SSI partners, focusing on our niche in the market around trust and payment infrastructure, which can be then utilised within other SSI software packages or products.

We want to create full production ecosystems for our clients, and the best way to achieve this is through collaboration. Over the last year, companies such as Animo Solutions have made excellent strides in refactoring and expanding the Credo SDK and launching their enterprise product, Paradym, to support the EU Architecture and Reference Framework (EU ARF) standards and protocols for credential issuance and exchange. Similarly, Walt.id have created an array of Open Source libraries for building alongside the EU ARF, namely the Community Stack, as well as working their new Enterprise Stack. With eIDAS 2.0 and the EU ARF now getting significant traction in Europe, it is imperative for us to build support into these ecosystems, and we are also working closely with EBSI and within the European Blockchain Sandbox to ensure that our trust and payment infrastructure is primed for adoption in Europe.

We therefore want to position cheqd Studio as a set of APIs that complements the work at the credential issuance and wallet layers, and is not perceived as competing with them. Already this mentality is reaping its rewards, with our partners Danube Tech, Talao, Mailchain, Walt.id and Animo now supporting did:cheqd, with more exciting announcements coming in the following months.

Conclusion

Our refinement of cheqd Studio to cheqd Studio is a reaffirmation of cheqd’s unique selling points, helping to productise our brand and provide a consistent product narrative for our community, partners and customers to buy into. It enables us to focus deeply on our specialist functionality: trust and payment infrastructure for digital credential ecosystems.

You can get started with cheqd Studio now: sign up and create your first API key to start integrating our APIs into your existing products, or let us help you build an end-to-end trusted ecosystem from the ground up.