Web of Trust, As We Know It, Is Flawed

The core concept behind the original Web of Trust is based on actors (through cryptographic keys) vouching for each other. Quoting directly from Phil Zimmerman (emphasis mine):

As time goes on, you will accumulate keys from other people that you may want to designate as trusted introducers. Everyone else will each choose their own trusted introducers. And everyone will gradually accumulate and distribute with their key a collection of certifying signatures from other people, with the expectation that anyone receiving it will trust at least one or two of the signatures. This will cause the emergence of a decentralized fault-tolerant web of confidence for all public keys.

Reputation should often naturally decay over time

Proof-of-authority systems like the one above often model for reputation to go in only one direction: upwards. Actors who have been around longer gather more “stamps” of approval. This can be an issue because:

- What if the actor was once reputable, but has had a change of heart on their morals? Or, in the case of companies, been acquired by new owners who have a vastly different ethical/reputational stance?

- Although the ideal of such decentralised PKI/reputation systems is to decentralise control so that no single actor becomes too powerful, the reality is that such power tends to coalesce towards a handful of actors. How can we escape the pull towards formations of natural monopolies?

- Regardless of whether once-trustworthy actors start behaving like their evil-twin-from-another-dimension, high-reputation actors become even more valuable targets for hacks, such as when Wired writer Mat Honan lost much of his online presence due to hackers wanting to take control of his three-letter @mat Twitter handle.

Doesn’t meaningfully capture the multidimensional nature of reputation

Records of which keys/handles/identifiers vouch for others only goes so far as to say I believe this key/handle/identifier is trustworthy. That doesn’t model the multi-faceted way in which humans interpret reputation:

- A person could have a stellar reputation as a skilled doctor/engineer/teacher/artist/(insert profession here)…but have a terrible reputation in other aspects of life, e.g., credit score, being a good parent, ability at swimming, etc.

- A company could be delivering great returns to shareholders but have a terrible reputation for ESG (environmental, social, governance) or worker rights.

This is highlighted in previous RWOT proceedings, such as the discussion on Anonymous Credentials in Sovrin:

Sovrin also supports reputation events. These transactions may be public (unencrypted) or private (encrypted) and can support any type of reputation assertion. At the most basic level, reputation events enable an observer to trust that the ledger entry identifying an Issuer really is the issuer. This bootstrapping of trust could of course also be established “off-ledger”, for example by pointing to the Sovrin ledger entry from the Issuer’s website or distributing an X.509 certificate of the Issuer’s public key.

But, trusting an X.509 certificate or a DID on its own doesn’t contain enough semantic information on whether to trust the issuer on that particular topic.

Reputation lies in the eyes of the beholder

Even if there was a model to capture multi-dimensional reputation, what is trustworthiness or reputation, anyway?

- Extending that example of company ratings/certifications, should oil & gas companies count in ESG stocks? Is it better if a coffee brand is Fairtrade or Rainforest Alliance certified?

- Wildly different approval ratings for politicians such as Donald Trump, based on political affiliation.

It is extremely tempting, like Vitalik Buterin and other authors of the “soul-bound tokens” paper did, to try build “on-ledger” reputation systems that provide a single “source of truth” for reputation. What this misses is if I’m a professional in a certain field, my clients may want to check my professional skills, but they have no business also knowing my credit-worthiness.

Taking a Page Out of Sports Rankings

How could we find a decentralized mechanism for reputation that addresses the shortcomings outlined above? The answer could lie in similar complex systems in the field of sports.

Ranking systems for chess, tennis, football, video games etc often rank players/teams using a system called Elo ratings. This is done by modelling interactions as a series of zero-sum games, where at a basic level:

- If the higher-rated player wins, a few points are taken from the lower-rated player.

- If the lower-rated player wins, a lot of points are taken from the higher-rated player.

- If it’s a draw, the lower-rated player gains a few points from the higher rated player.

A more common term that some may know these systems is brackets or playoffs, as visualised below from a FIFA Football World Cup 2022 bracket chart…

An unlikely inspiration from Tinder and Netflix

To understand how this concept could apply to dynamically bootstrapping a reputation system, we can take a look at how Tinder used Elo ratings to rank profiles in their app. Essentially:

- If any two users both swiped right on each others’ profiles, it count as a “win” in Elo rating terms.

- Similarly, both users swiping left counted as a loss.

- If one user swiped right and the other left, that would count as a loss too – but would have a different impact on rankings based on their relative rankings.

It is worth acknowledging that sometimes such Elo rating systems can be gamed, and if designed badly, can lead to inequitable outcomes. (Tinder moved away from using Elo ratings themselves.)

Another example of this is how Netflix moved from stars to a thumbs-up/thumbs-down rating system (sometimes called a “Nero rating system”, after the Roman emperor), essentially turning their rating signals to a zero-sum game between their estimate of how much they think a viewer will enjoy a title versus how what the viewer rated it as.

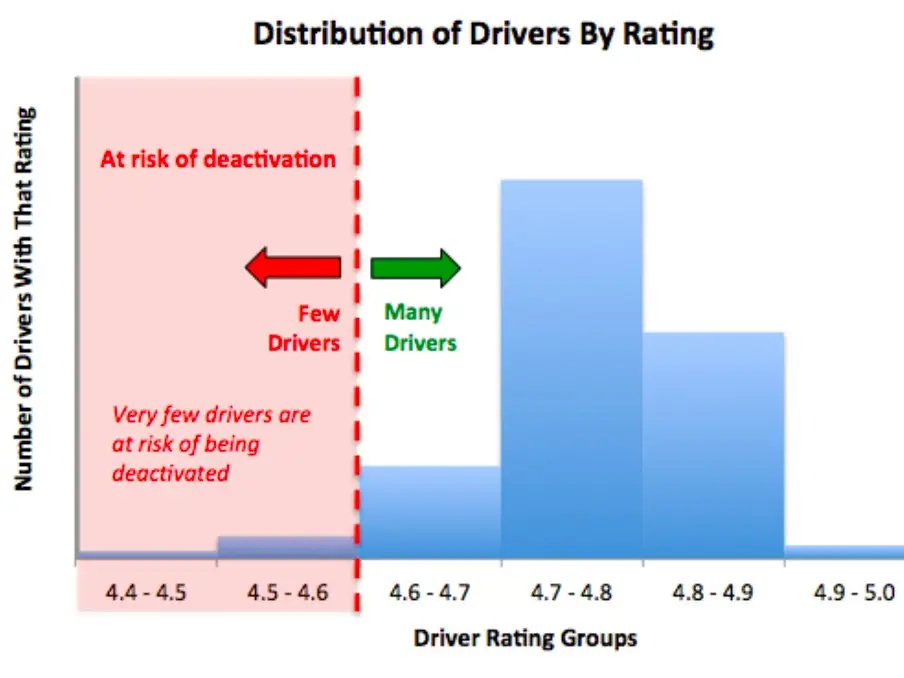

The key insight there was that given a 5-point rating system, people gravitate either towards 1 or 5: the rating scales in the middle see much fewer choices being made. This is not an isolated example: YouTube came to the same conclusion switched away from stars. Uber driver ratings below 4 are basically a strong enough signal to kick a driver off the platform, since 2s and 3s hardly get used. This also mirrors Uber passenger ratings distribution scale.

Other examples of zero-sum games to "rank" things

- AlphaGo and other AI systems use adversarial machine learning to rank game strategies.

- reCAPTCHA uses zero-sum game elements for known inputs while training for unknown inputs at the same time.

Applying Elo ratings to decentralized reputation

A decentralized reputation system could similarly bootstrap reputation scores per topic or attribute much faster than trying to accumulate “stamps” over time.

Some thoughts on potential benefits could be:

- Reputation scores could go up as well as down. Elo ratings naturally decay over time due to inactivity, just like how sportspeople who drop out of a sport drop out of league tables. Applied to reputation, this provided a sliding time window over which reputation could decay.

- Crucially, even “new”, low-ranked actors in a certain domain could trigger a reputation event that states This higher-ranked actor is no longer nice. On their own, a single lower-ranked actor couldn’t significantly impact a higher-ranked one – which prevents Sybil attack scenarios. But, given enough actors stating positive/negative experiences, scores will change over time.

- This does not mean an actor has a single reputation score – or a single score on how trustworthy their key/handle/identifier is. They could dynamically maintain different reputation scores on different topics. E.g., a company could have a high “buy” rating for their stock on financial metrics, but a low reputation on ESG. These can tied to Decentralized Identifiers (DIDs), for example, and assessed by the beholder differently.

- Doesn’t necessarily need to be on-chain. It could be off-chain/off-ledger and shared on a case-by-case basis: the same way Verifiable Credentials are.

- Finally a potential alternative to the question How do I know this issuer/DID is trustworthy? instead of sharing lists of trusted DIDs manually or

.well-knownDID configuration which is basically back to relying on centralised PKI / domain name reputation. - Extending that same idea, it could also apply to trust frameworks, governance frameworks, schemas etc. When a verifier is presented a credential from an isssuer/framework/schema they have never seen before, they can dynamically query the Elo rating based reputation score of each of those on that particular topic/domain and assess whether to trust the credential.

Closing comments

Obviously, there are lot of things to map out on how to make this work in technical implementation, threat-modelling scenarios such as Sybil resistance, and ensuring there are safeguards to prevent unethical behaviour. I would love to collaborate at RWOT to map out other pros/cons not listed here.

However, this Elo ratings could provide a radically different reputation model than centralised PKI, WOT-based decentralised PKI, or soul-bound tokens / SBTs (which offers no consent-led mechanisms to reject malicious reputation statements). Instead of having to invent something entirely novel, Elo ratings are a well-researched and rigorously-modelled mathematical field.