Q3 2025 has been focused on improving the quality of cheqd’s services, from the core ledger all the way up the technical stack to cheqd Studio. Our focus on building and quality this quarter has also been reflected in an uptick in cheqd users across the board, with mainnet network transaction writes increasing and cheqd Studio sign-ups following suit.

This product update will breakdown the key milestones we’ve made across our product suite, and also give a sneak preview of what we’re working on next, across:

- cheqd Network

- cheqd Studio

- Customer Feedback

- SDKs and Core Tooling

Overall, the progress and steady increase in adoption from Q3 validates our product hypotheses, allowing us to double down on quality, innovative features and customer-led growth going forward for 2025 and into 2026.

cheqd Network

We have been busy with on-chain governance this quarter, releasing a new major version (v4.x), a minor stability patch (v4.1.4), reducing the mainnet inflation and funding OriginVault’s Public Utility Tool.

At the start of Q3 2025, we launched our v4 cheqd Network upgrade which upgraded cheqd mainnet and testnet to v0.50 of the Cosmos SDK, named “Eden”. This upgrade brought state-of-the-art Cosmos features to the network, including ABCI++ and optimistic execution as well as expanding cheqd DID Documents to support DIDComm natively on ledger.

In September, we upgraded the network further to v4.1.4, fixing historical issues with state sync, pruning and IAVL heights, improving the stability of the network and making it easier for validators to restore from state sync.

Across both network upgrades, we also enabled various components of fee abstraction, meaning that any transaction can be denominated in IBC enabled currencies such as USDC (Noble). The network now uses a CHEQ/USDC pool on Osmosis to settle between IBC enabled currencies on-the-fly.

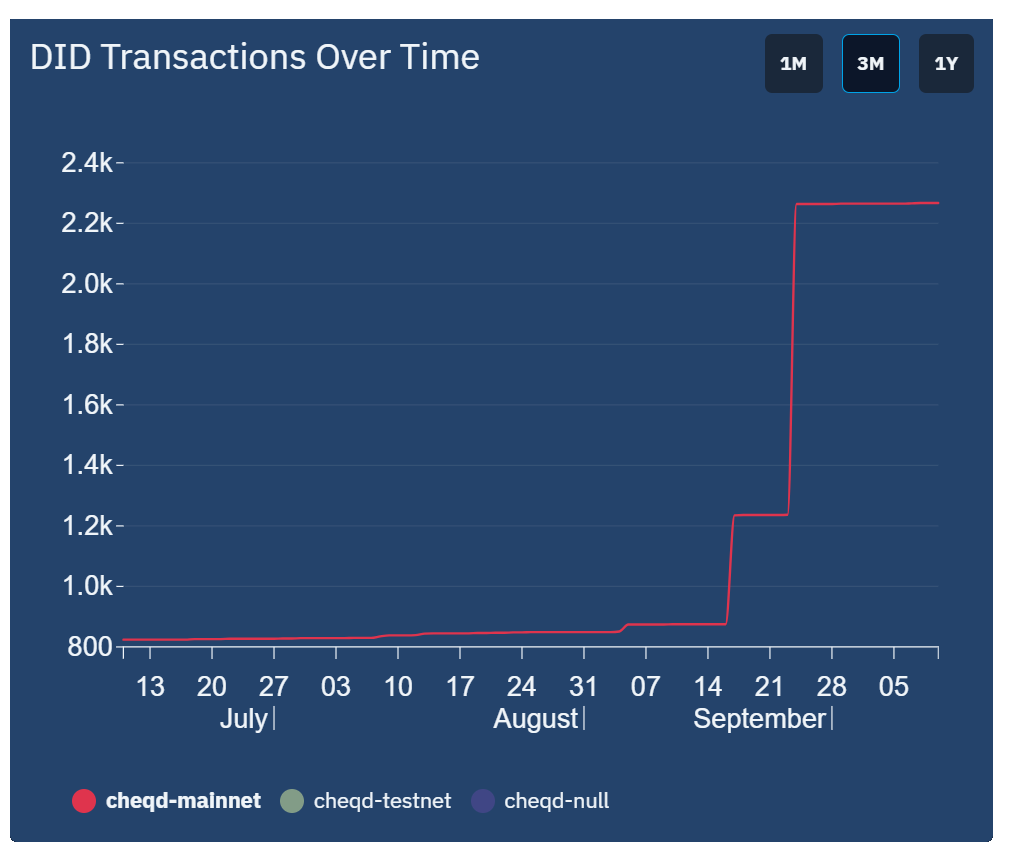

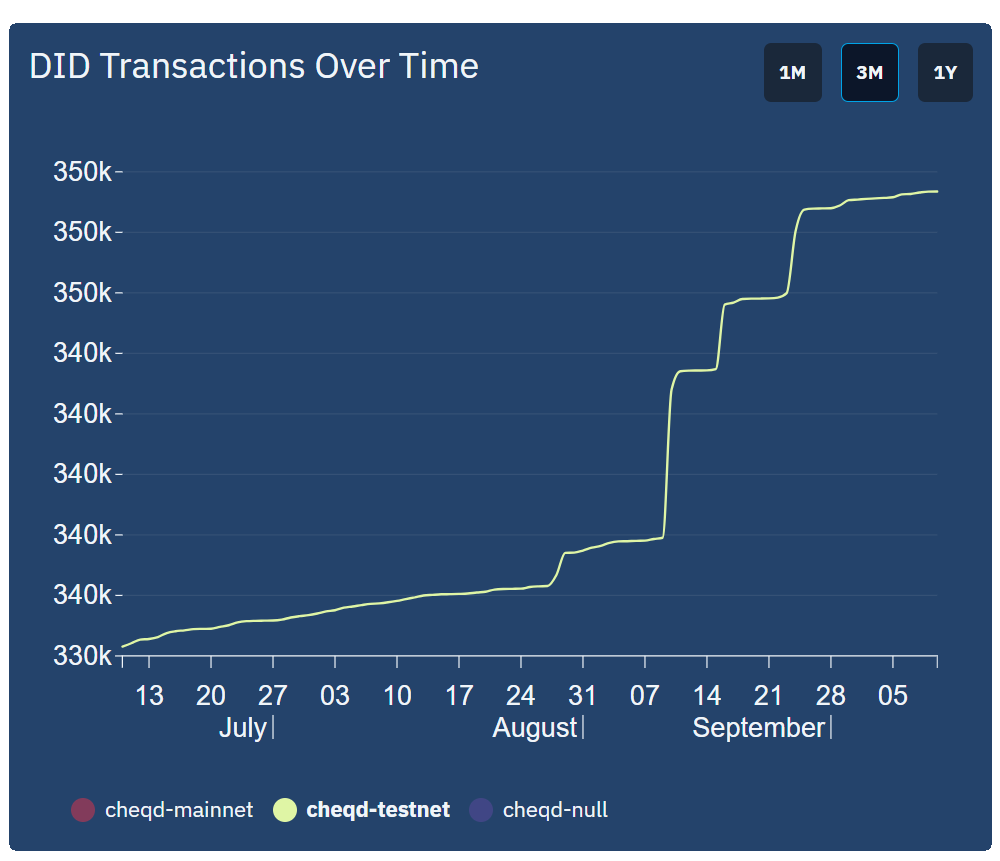

Our commitment to keeping the network best-in-class has led to a significant upturn in adoption, with ~1,425 mainnet DID transactions coming this quarter and a steady increase of ~20,000 testnet DID transactions. As more customers continue to build and test on our testnet, we expect the number of DID transactions on mainnet to increase as they begin to transition across to mainnet.

Concurrently, the cheqd community voted for a reduction in the upper band of network inflation, from 4% to 1.5% to help return the total supply of CHEQ to 1,000,000,000 total tokens, via a balance of lower inflation and transaction burns.

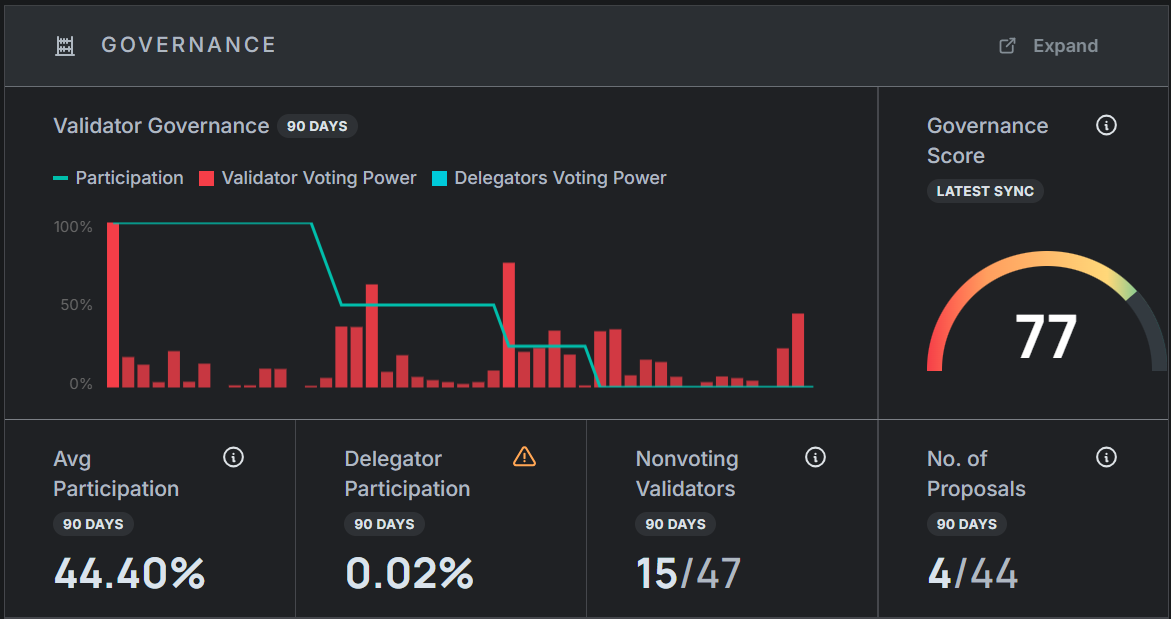

This on-ledger activity from Q3 has also resulted in a strong Governance Score of 77 for the network, showing the power of engagement of the community and validators to make crucial decisions on the network. This aligns with one of the core principles of increasing network entropy that we set out in our initial governance framework.

Finally, it’s worth a shout out to the team at OriginVault who have been rewarded 1,000,000 CHEQ from the community pool this quarter to fund the creation of Public Utility Tool (PUT), “helping to establish cheqd as the default identity and provenance ledger for creators.” We will continue to work closely with the team as PUT rolls out to make sure that content credentials and metadata provenance are supported by the core network and its identity tooling.

Next quarter, we will be continuing to improve our core network. We are currently preparing to roll out our next major upgrade, creating an on-chain oracle to stabilise the cost of identity transactions against fixed dollar values. For enterprise customers, this will create stability in the cost of DIDs and DID-Linked Resources on ledger, without the risk of price fluctuation. Stay tuned folks as the momentum is building!

cheqd Studio

Our primary developer focus across Q3 has been expanding cheqd Studio into an enterprise application with a highly functional user interface. Previously, cheqd Studio was an API-only product, however, now users can use cheqd’s services with a complete no-code interface.

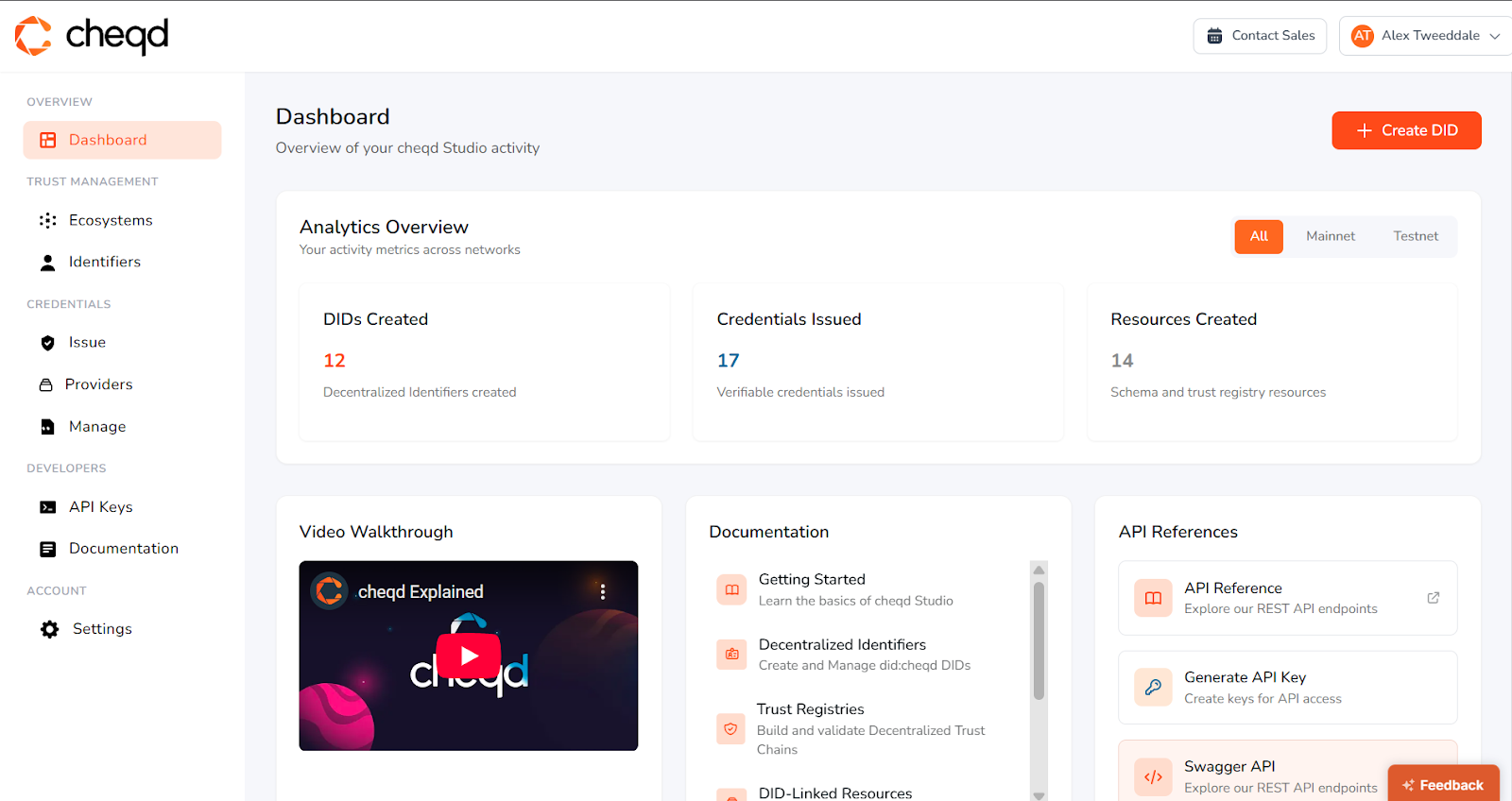

The new cheqd Studio dashboard is a homepage for accessing the APIs, documentation and viewing metrics about DIDs, DID-Linked Resources and Credentials issued on the platform.

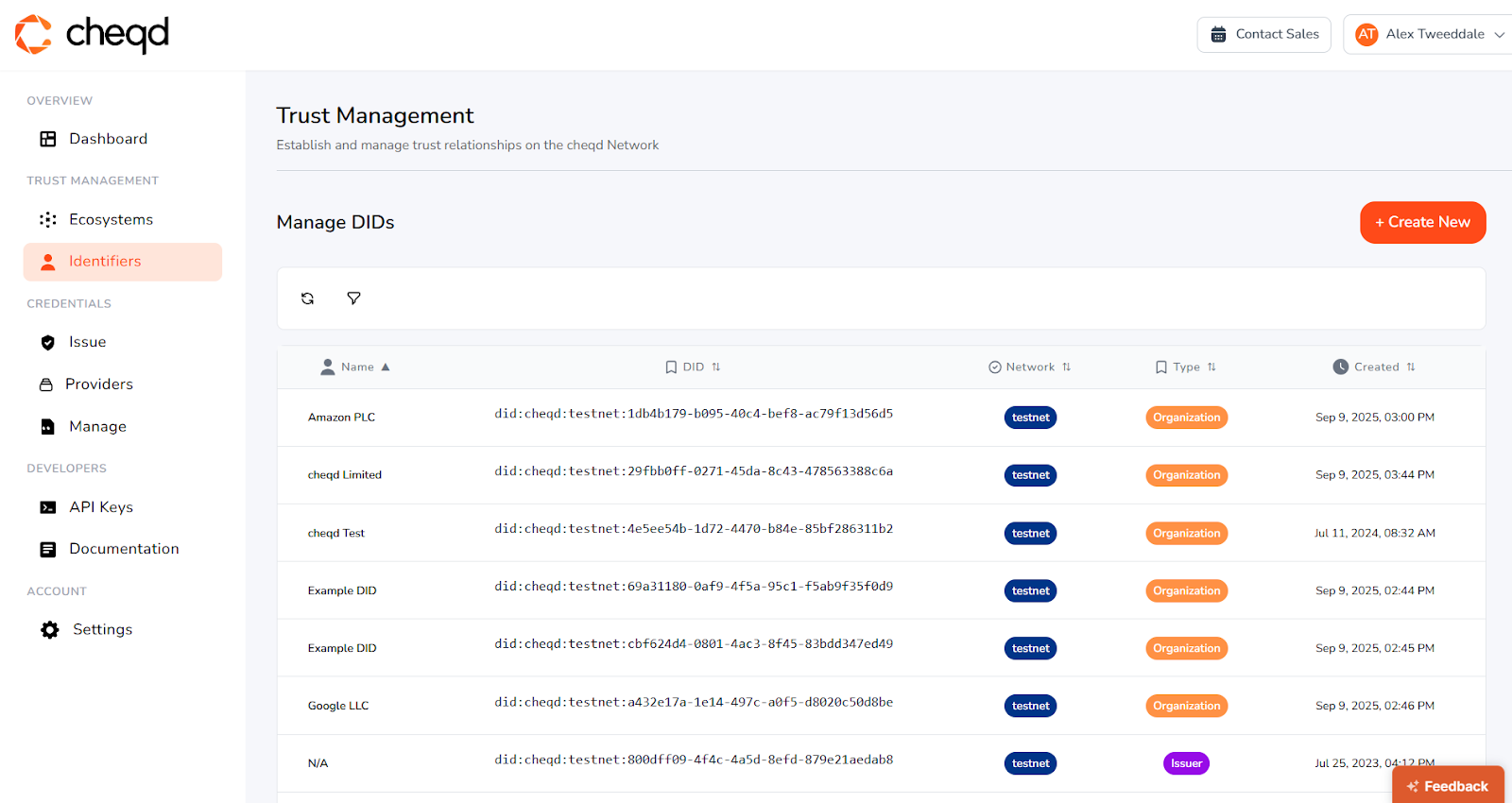

From here, we’ve created a new Identifiers page, where users can view, manage and filter their created DIDs on testnet and mainnet.

Clicking into each DID, allows users to view the Linked Resources attached, as well as update the DID Document manually. Even for developers and API-native users, this provides a much cleaner interface for managing DIDs, abstracting away the requirement to have a full understanding of the complexity around DID Documents or DID-Linked Resources.

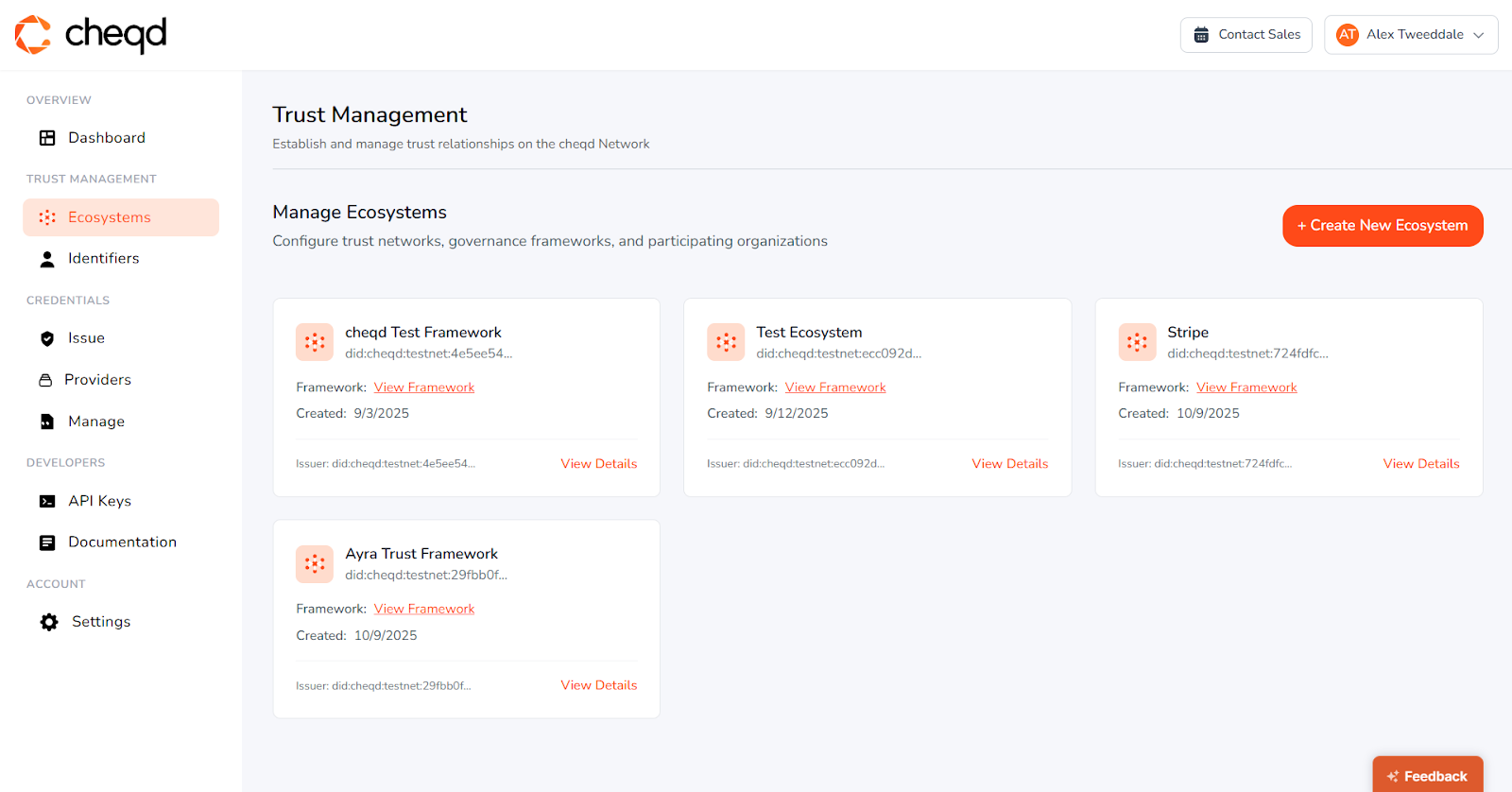

After creating DIDs, users can now create trust ecosystems directly in the user interface, giving the ecosystem a name and a Root DID. On ledger, this creates a Root Authorization for Trust Chain, setting the governance baseline and the schemas supported for the given ecosystem.

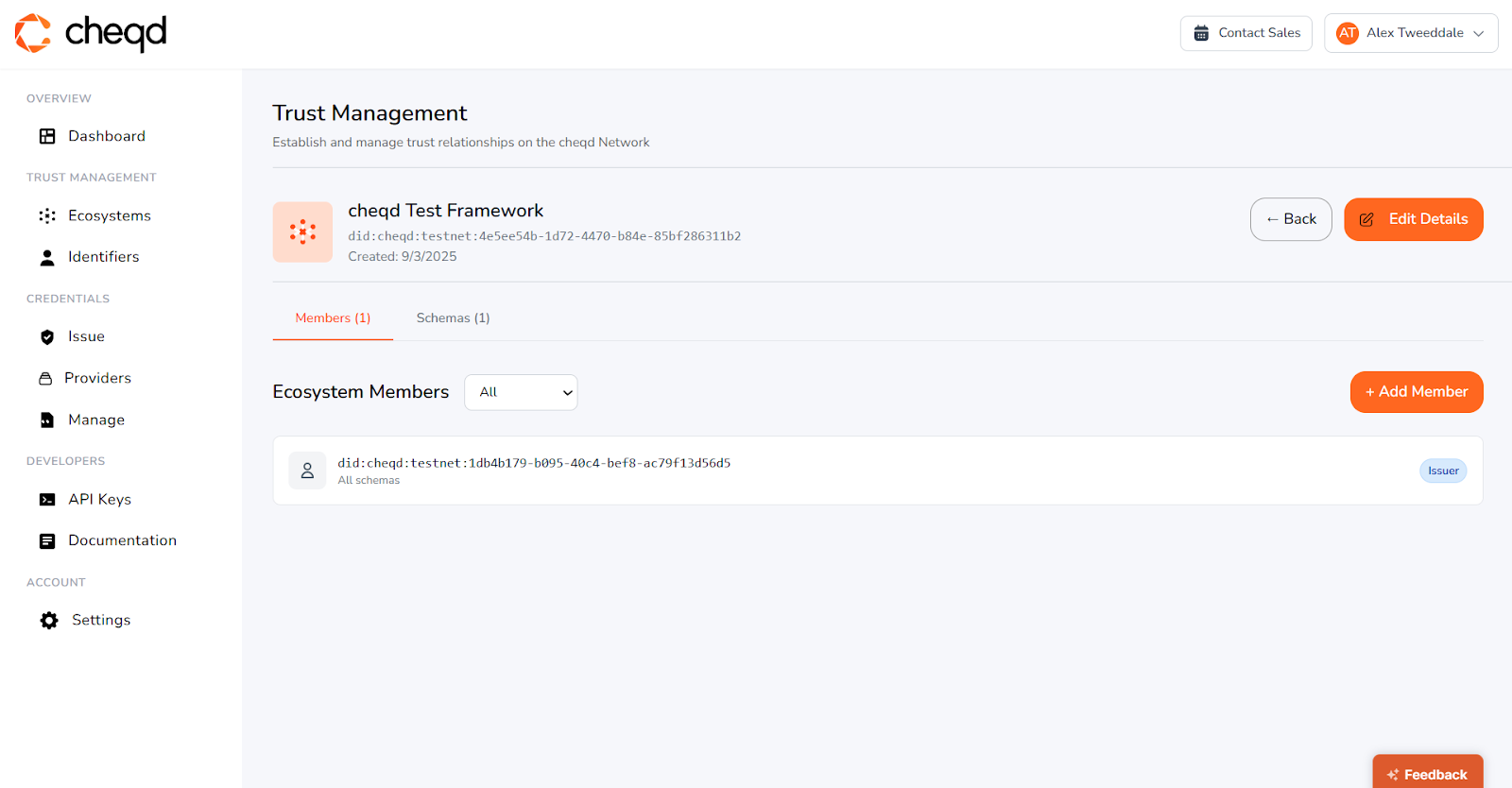

From here, users can now add DIDs to their trust ecosystem, specifying whether the user is a credential issuer or an accreditor (such as an auditor), and assigning that member permissions based on the schemas associated with the top-level ecosystem.

Adding DIDs into the ecosystem creates an on-ledger Verifiable Accreditation from a Root TAO to a TAO or Trusted Issuer, following the Decentralized Trust Chain hierarchy, described in our docs. Through this new functionality, our customers can build trust graphs for organizations or AI Agents in their ecosystem, embedding trust directly into the identifier of the entity.

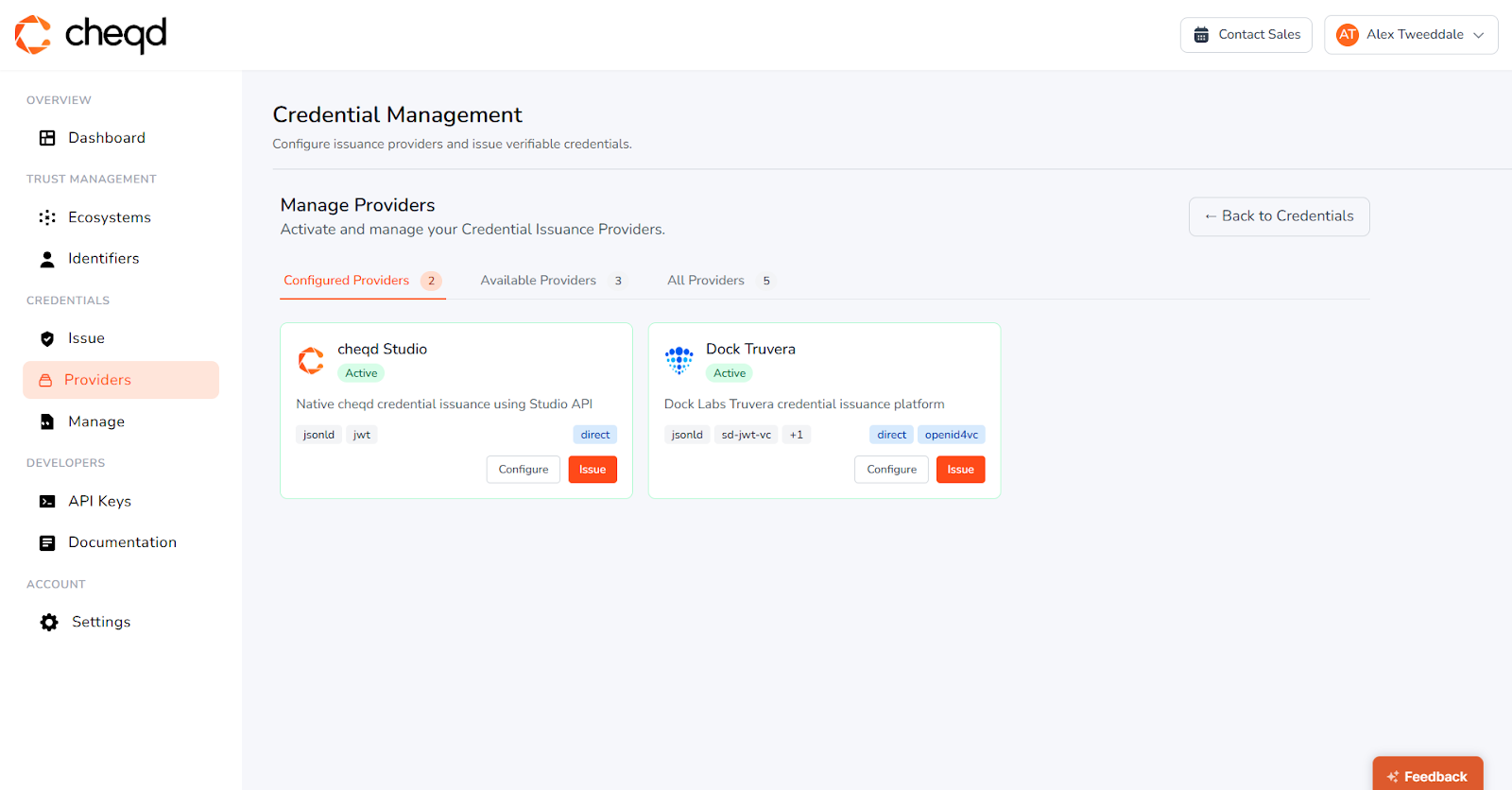

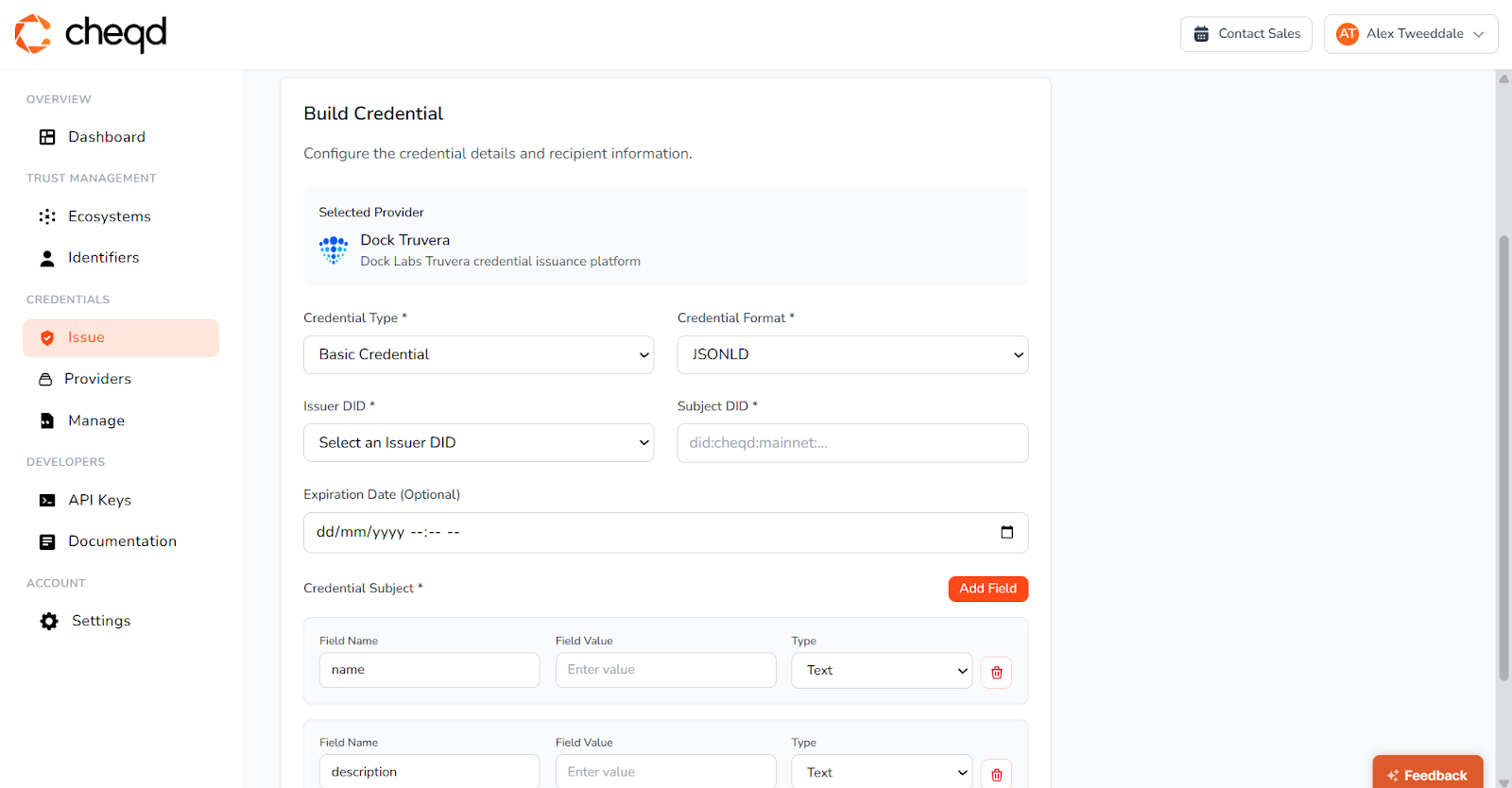

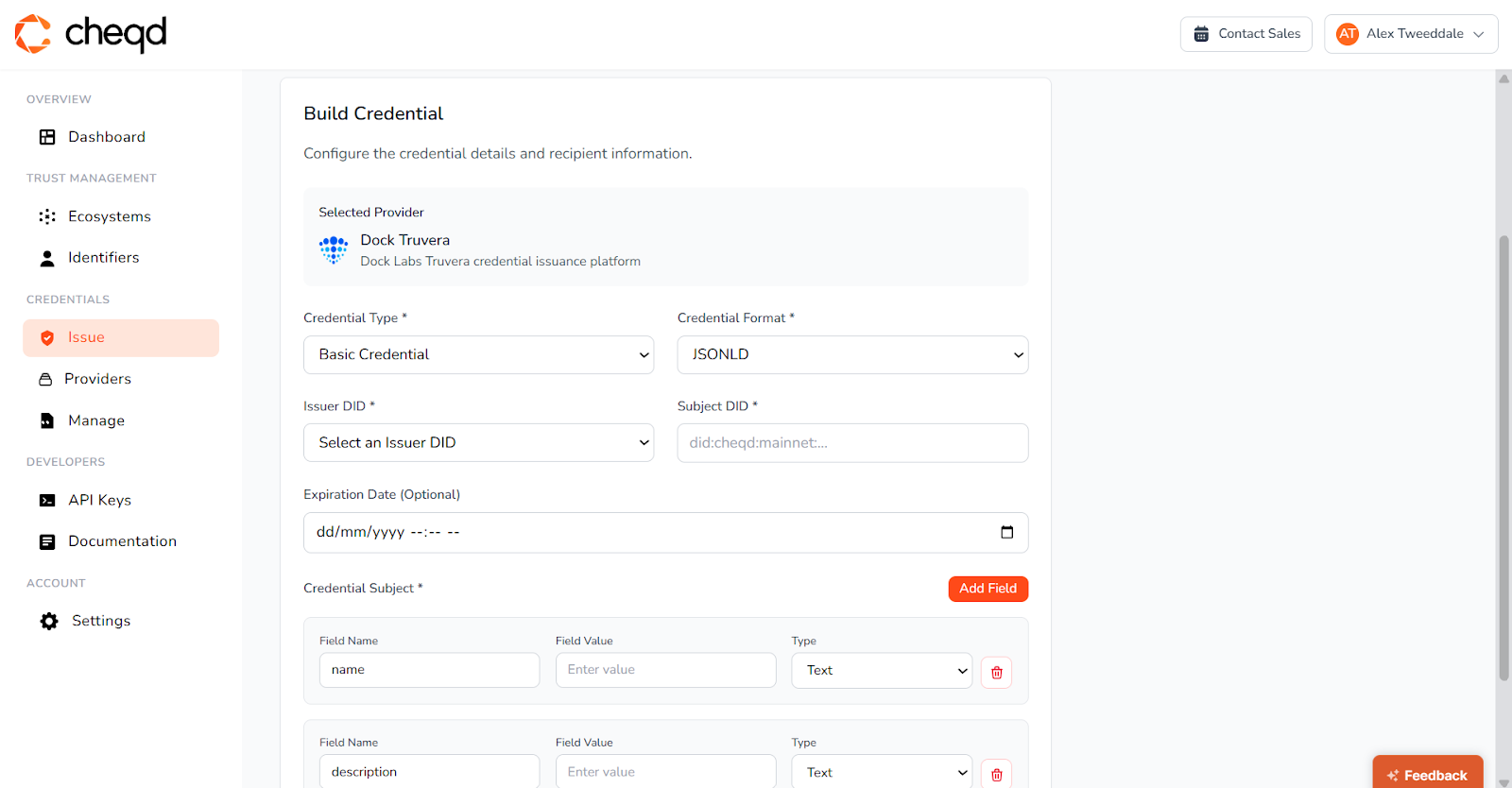

Once users have set up their DIDs and trust ecosystems, they can now configure different credential issuance providers to issue Verifiable Credentials directly to identity wallets. The cheqd Studio provider supports issuing VCDM 1.1 JWT or JSON-LD credentials and storing the VC on-ledger (optional), while Truvera (Dock.io) supports issuing credentials directly to the Truvera Mobile Wallet.

Other credential issuance providers such as Hovi and Paradym are currently in the pipeline, giving our users complete flexibility in what types of credentials, exchange protocols or wallets they want to use.

Once configured, users can now build custom credentials using a simple form view and issue them directly to a wallet of their choice!

Of course for developers that want to use the API directly, we support API key based authentication, with the ability to generate and manage API keys, and then use our API Reference to get started.

Altogether, this new work on the user interface provides the most cohesive way for customers to use cheqd to-date, and based on this work, we are now seeing monthly jumps in active users on cheqd Studio. Internally, the latest release including the credential provider and issuance support is being labelled our ‘MVP’, which will allow us to fully test out the product in the market, build a customer base and iterate out with a customer-led focus.

Customer Feedback

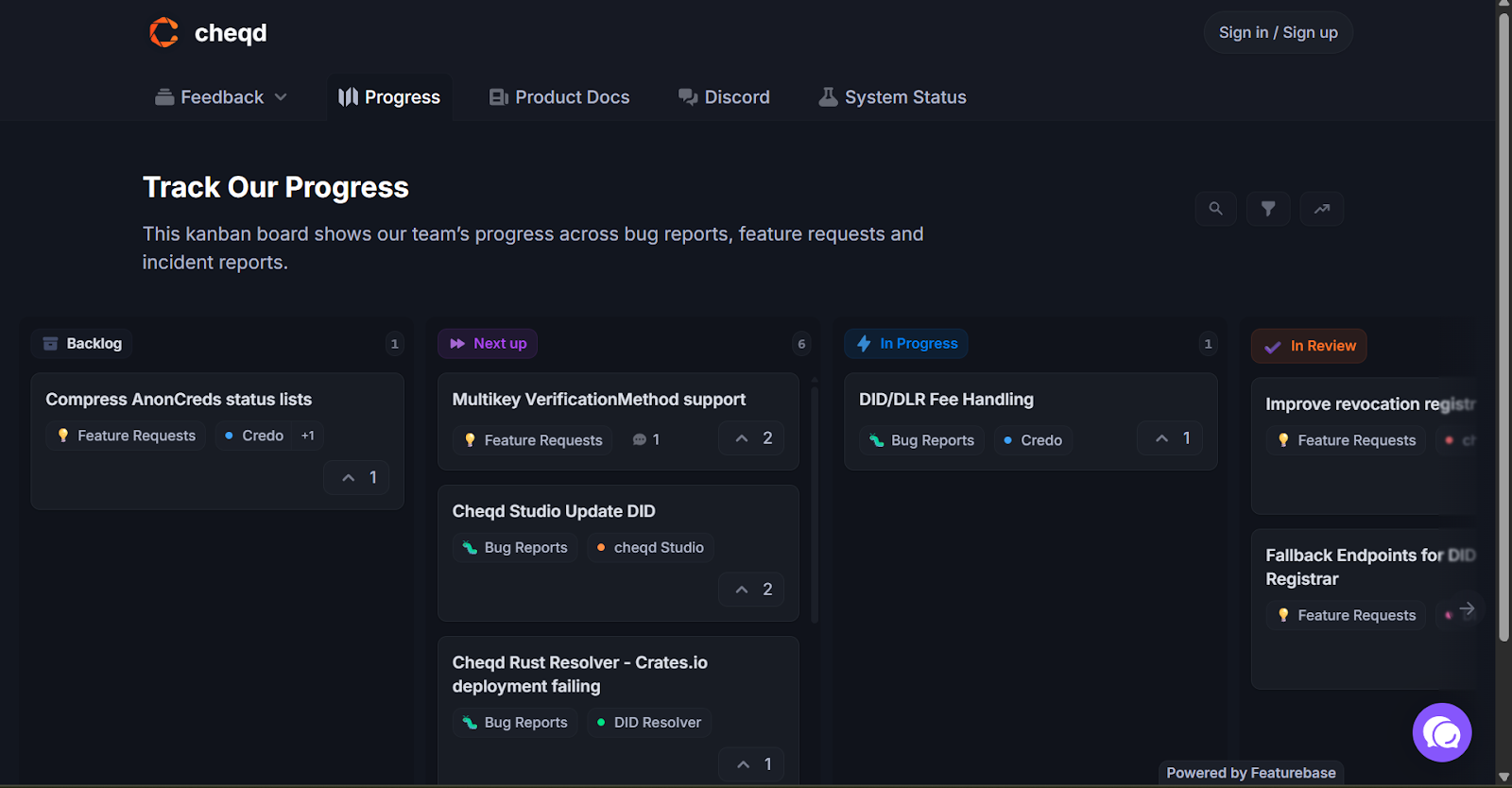

As we’ve continued to improve our tooling and products, such as cheqd Studio, we’ve also launched a new Feedback site to collect bug reports, feature requests and track incidents. Our community can now track and follow the progress of these requests/reports as they move along in our sprints from backlog to completion.

This allows us to transparently triage and manage tasks that are reported publicly, and notify the reporters once progress has been made and the report is closed.

SDKs and Core Tooling

SDKs are the plumbing of all of the identity functionality we use in cheqd Studio and beyond. Working together with our partners such as Dock, DIDx, Animo, Hovi and Anonyome, we have continued to improve our SDKs in terms of usability and features.

For example, we have been tracking the work in EU Digital Identity with the European Architecture & Reference Framework and have been aligning ourselves with the standards and protocols set out in the framework. For example, we have built the first ever ledger-based Token Status List revocation mechanism into the Credo SDK. This allows anyone issuing SD-JWT VCs (a new credential type created by IETF), to use cheqd DID-Linked Resources for persistent and versioned revocation registries, even if DIDs aren’t used to sign the credential. In a world where X.509 certificates, DIDs (with defined profiles) and JWT Issuer Metadata may all be used to sign SD-JWT VC credentials, this gives cheqd a way to be valuable for all potential implementations.

With recent work from the German SPRIN-D team to finalise the standards for OpenID for Verifiable Credential Issuance and OpenID for Verifiable Presentations, we are going to explore how we can directly support these (now stable) protocols within cheqd’s SDKs to be able to issue verifiable credentials to a wider array of identity wallets with full interoperability. We are also continuing to actively participate in standards organizations that are leading the charge on getting credentials to mainstream adoption, such as ToIP, DIF, CEN/CLC, C2PA and UNTP.

What’s Coming Next?

A strong foundation of building in the last few years has led to a tangible improvement in growth and adoption. We aim to build on this trajectory in the next quarter and into 2026. As we gain more customers and get more users on the network, SDKs and Studio, this customer-focus will inform our product development, together with our own market insights, going forward.

That being said, we already have some exciting features planned across the board that we’re already in the process of shipping – including our new oracle release on cheqd Mainnet, enterprise-focussed credential payments within cheqd Studio and continual push to support verifiable AI Agents with cheqd identity and trust registries pinned underneath.