The European Commission has introduced a major proposal that could redefine how companies operate across the Single Market: European Business Wallets. Positioned as a cornerstone of the EU’s emerging Digital Public Infrastructure, these wallets aim to simplify cross-border operations, cut administrative burdens, and strengthen the competitiveness of European enterprises.

For years, businesses (particularly SMEs) have spent disproportionate time navigating fragmented compliance processes, manual paperwork, and inconsistent digital systems.With this proposal, the EU is signalling a shift toward a unified, interoperable, and trusted framework for digital business interactions.

For organisations building digital identity, trust frameworks, and verifiable data ecosystems, this is a significant moment. The Business Wallets echo many of the principles cheqd has been advocating: user-controlled digital credentials, trusted identifiers for legal entities, interoperability, and privacy preserving trust exchange.

As the legislative process begins, the proposal sets the stage for one of the most ambitious digital transformation efforts in the EU to date.

What’s in the Proposal and What Benefits Does It Bring?

1. A Single, Trusted Digital Identity for Every Business

The proposal introduces a wallet-based digital identity that gives each company a unique, persistent identifier recognised across all 27 Member States. This enables businesses to prove their identity online with full legal effect and to authenticate securely in both business-to-business (B2B) and business-to-government (B2G) interactions. These days, companies are stuck dealing with a messy mix of national IDs, LEIs, random portals, and different verification systems for every sector. It’s slow, repetitive, and honestly a bit painful. The Business Wallet basically cuts through all that by giving businesses one trusted identity that actually works across the whole EU.

2. End-to-End Digital Credential Exchange

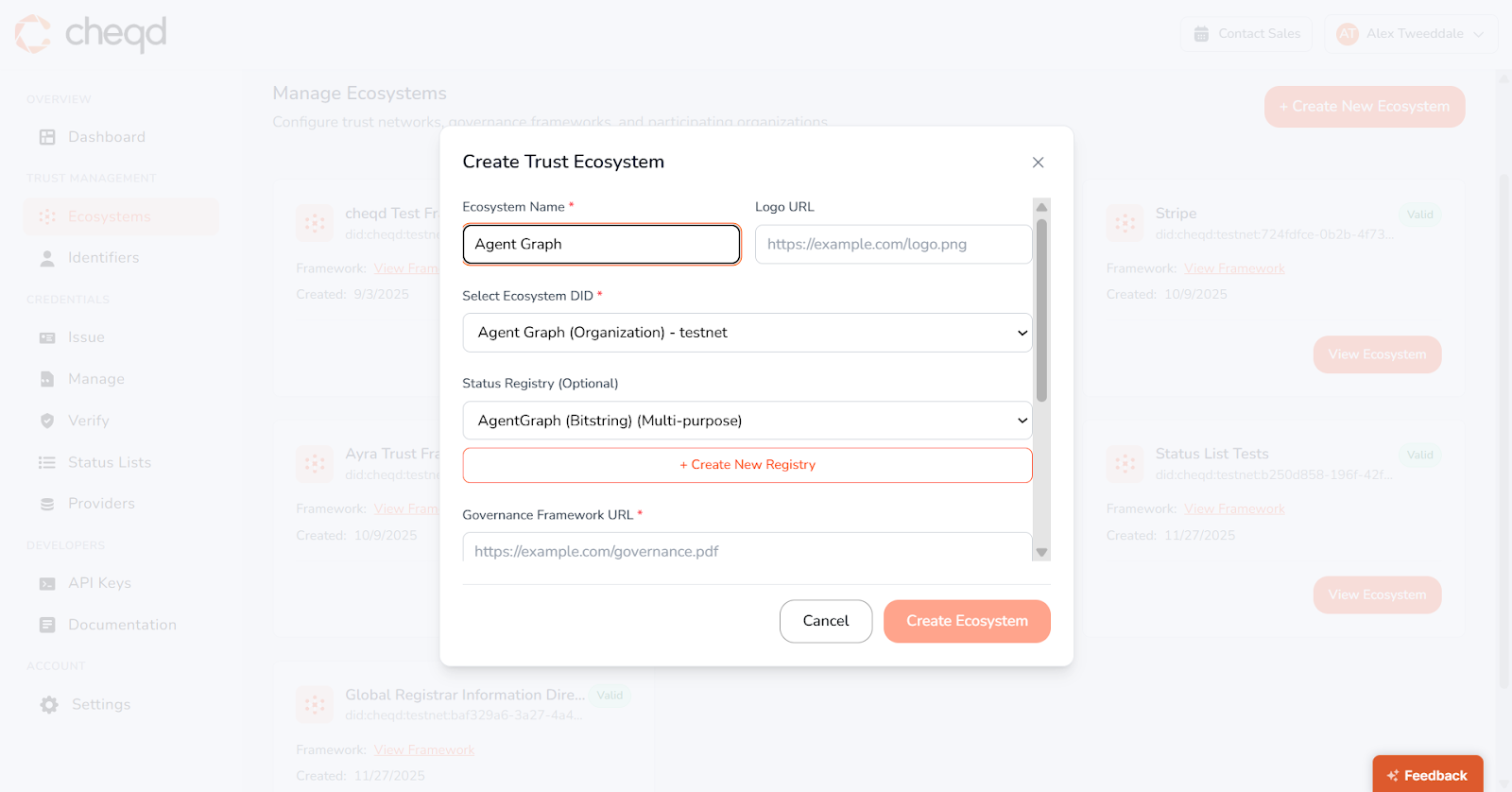

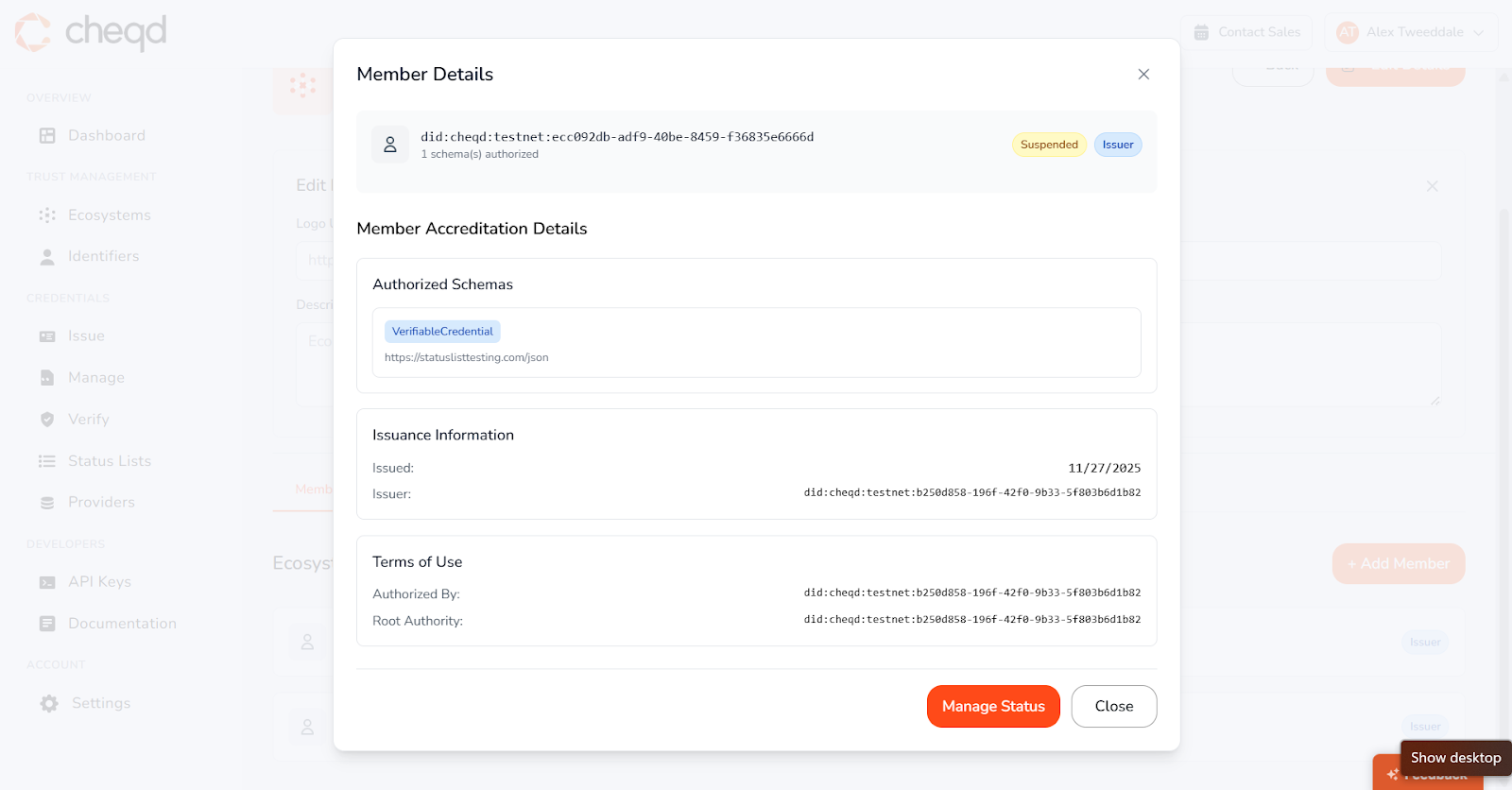

At the heart of the Business Wallet is a trusted environment for managing verifiable credentials. Companies will be able to create, store, receive and present verified digital documents such as licences, permits, certificates, and attestations, many with legal equivalence to traditional paper-based methods. They can digitally sign, seal, and timestamp documents, and share compliance-related information instantly with regulators and business partners. For sectors burdened by regulatory checks, such as finance, mobility, manufacturing, and energy, the ability to automate and reuse verified data across jurisdictions represents a substantial reduction in both time and administrative costs.

3. Reduced Administrative Burden and Major Cost Savings

Admin-related headaches have held businesses back for years, especially SMEs, which can end up spending 30–50% of their time just dealing with paperwork and compliance.All those manual processes can even eat up around 2.5% of their yearly revenue, which is pretty significant when you think about it (press release).The Business Wallet cuts out a lot of that duplication and makes everything properly digital, so day-to-day operations get smoother, compliance stops being such a drain, and costs actually go down. The European Commission reckons that simplification alone could save businesses €5 billion by 2029, and if Business Wallets really take off, the total savings could hit €150 billion a year (press release). Faster onboarding, easier procurement, and streamlined KYC/KYB are a big part of what’s expected to make that happen.

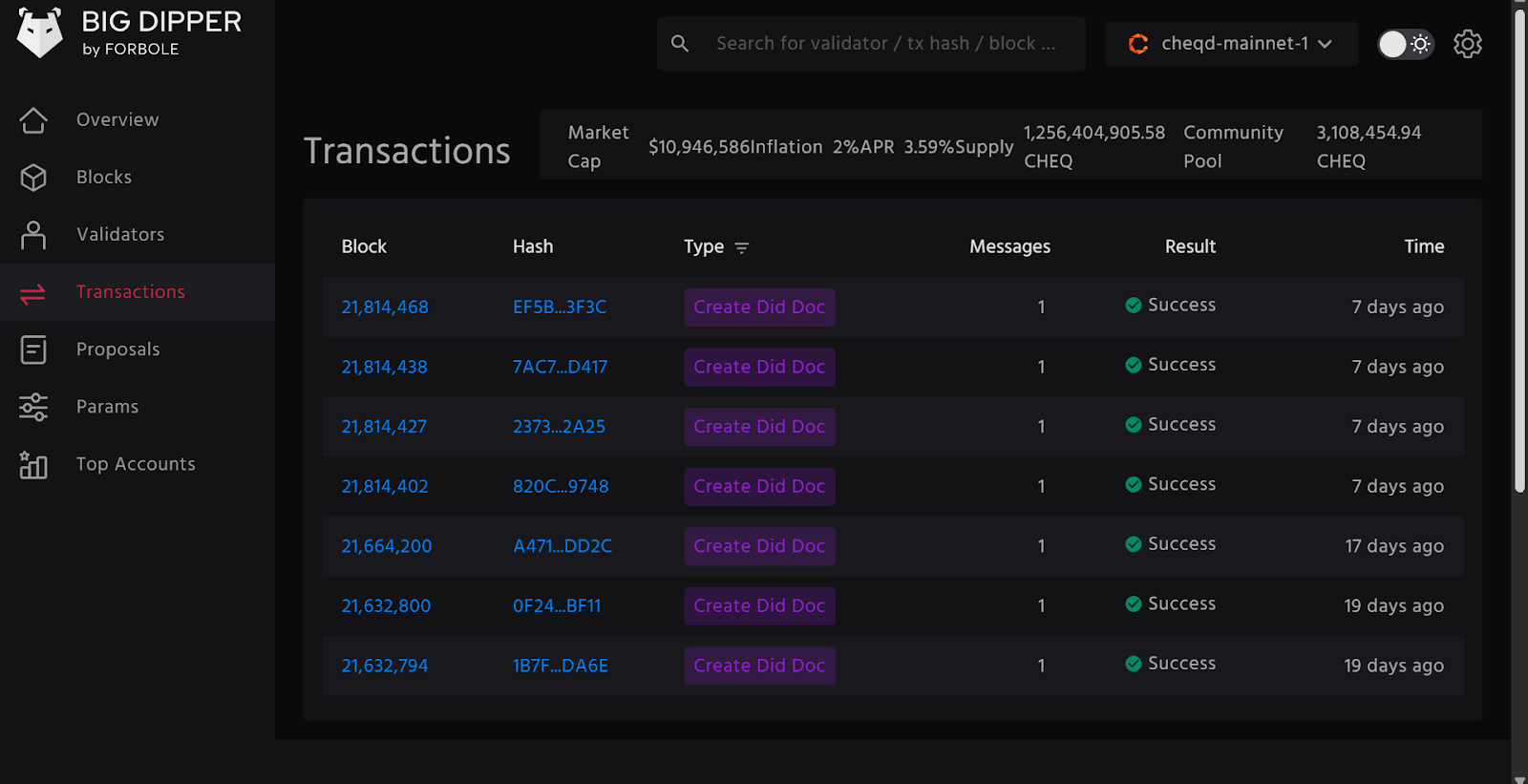

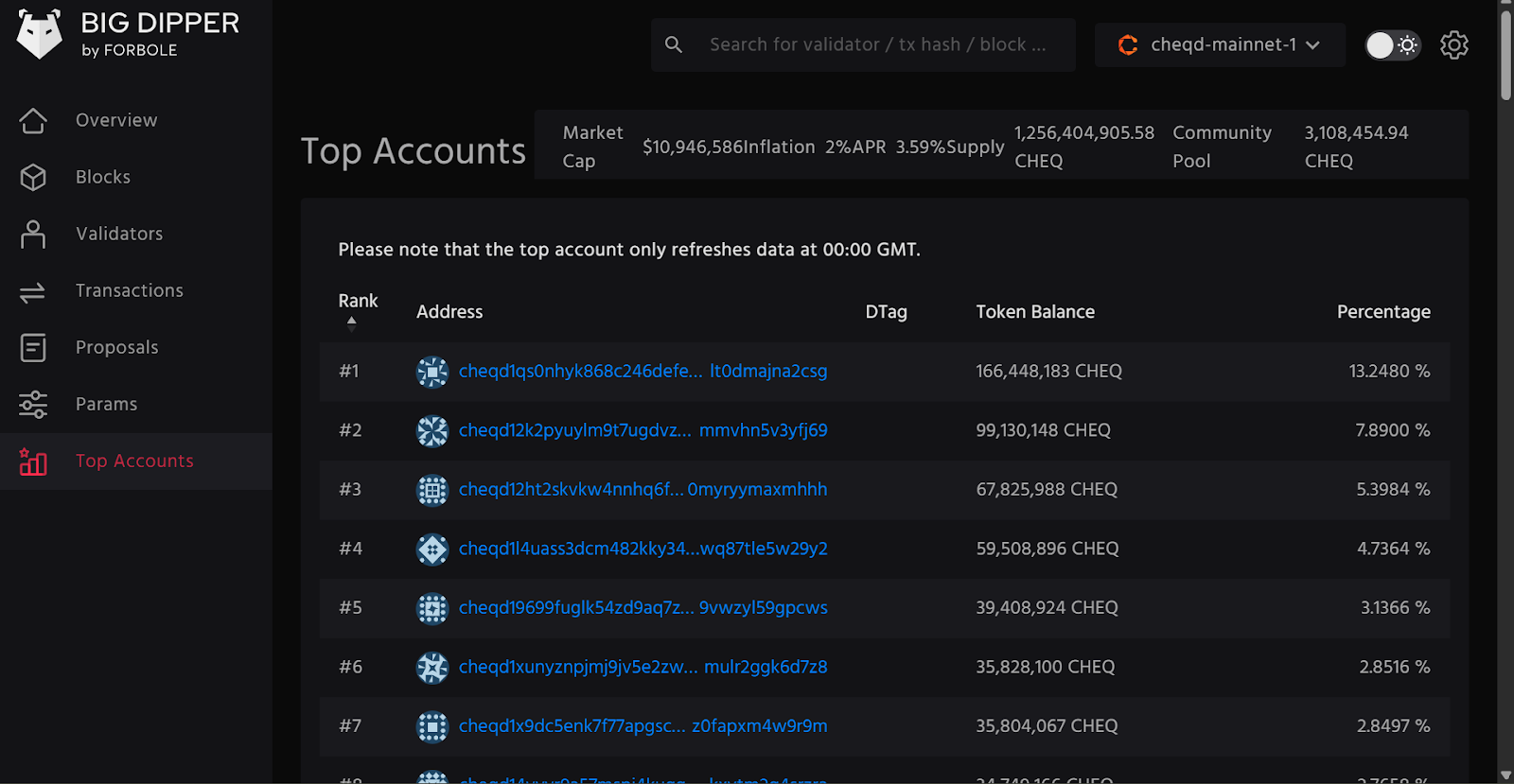

4. Built on the EU Digital Identity Framework

On the technical side, the Business Wallet is basically built on top of the EU Digital Identity Wallet framework. That means it comes with strong security, proper privacy protections, and easy interoperability baked in, all while staying fully in line with the updated eIDAS regulation. It also taps into big pilot projects like the WeBuild consortium: more than 180 public bodies and companies working together to try out real cross-border business use cases. By reusing components and standards that have already been tested, the EU can roll this out faster without sacrificing consistency or trust across Member States.

5. A Boost for Innovation and Competitiveness

Besides cutting down on the admin overload, the whole idea is meant to push innovation and help businesses grow. Instead of juggling different systems to prove they meet various EU rules, companies can use one harmonised setup, and public authorities get verified information instantly. Startups and scale-ups have an easier time expanding across borders, and digital service providers get a reliable base to build new tools and automation on top of. In short, the Business Wallet isn’t just about efficiency; it’s a key piece of the EU’s Digital Public Infrastructure. It creates a trusted, interoperable digital environment that supports growth, boosts competitiveness, and helps the whole economy move faster.

Mandatory for Public Admins. Voluntary Uptake by Businesses.

The proposal takes a fairly practical approach to adoption. Public authorities across the EU will be required to accept and support the core Business Wallet functions, but companies won’t be forced to use them. The idea is to create a single, trusted channel for official interactions, without pushing businesses into yet another mandatory system.

For public administrations, this means that verified digital interactions must be recognised across the Single Market. EU institutions, agencies, and national or local authorities will have two years from the regulation’s entry into force to support the Business Wallet. During that time, Member States can continue using existing national or sector-specific systems to avoid disruption.

For businesses, uptake remains optional. Companies can use the Business Wallet when it actually helps, especially for dealing with public authorities or managing cross-border requirements, without having to replace their existing tools. The expectation is that adoption will grow naturally as the wallet becomes the standard way to handle trusted, legally recognised business interactions across the EU.

Timeline of EU Business Wallet Milestones

29 January 2025 — Announced by Ursula von der Leyen in the Competitiveness Compass

- This was the political “kick-off” for the EBW. Ursula von der Leyen introduced it as a flagship initiative in the Competitiveness Compass, the EU’s roadmap to boost its economic growth, innovation, and simplify regulation.

15 May – 12 June 2025 — Public consultation (“call for contributions”)

- The Commission officially opened a “call for evidence” (i.e., public consultation) to gather input on the design of the Business Wallet.

- Stakeholders included SMEs, large corporations, IT vendors, industry associations, national business registers, Chambers of Commerce, and public administrations.

- The goal was to better understand the biggest challenges businesses face with cross-border operations, compliance, and admin overload and feed that directly into the regulatory framework.

- Alongside the written consultation, the Commission also scheduled expert workshops, interviews, and technical sessions running from March through September 2025 to dig deeper into the details.

19 November 2025 — Formal proposal published by the European Commission

- On this date, the Commission released COM(2025) 838, the formal proposal for a Regulation establishing the European Business Wallet.

Next steps after proposal

- The proposal goes through the ordinary legislative procedure, meaning it will need approval by the European Parliament and Council.

- The proposal requires public bodies to accept the wallet within 24 months of the regulation coming into force, with some transitional period up to 36 months.

End of 2026 (target) — Planned launch / availability

- According to the Commission’s policy page, once the regulation is adopted and enters into force, all public administration levels (EU, national, sub-national) will have two years to be able to accept the Business Wallet.

- If the regulation is adopted in Q4 2025 and enters into force soon after, many public bodies should be ready by around the end of 2027. However, “end of 2026” is cited in some target-setting as a rough benchmark (possibly reflecting adoption timeline + transitional phases).

A Secure and Interoperable Future for the EU

The European Business Wallet is set to become a major part of the EU’s digital transformation. It gives companies a trusted, interoperable way to simplify their operations, cut back on admin work, and grow more easily across borders. With a single digital identity and verifiable credentials, businesses of all sizes (from startups to big enterprises) stand to gain real efficiency boosts and new opportunities for innovation.

Of course, rolling out something this ambitious isn’t simple. Achieving full interoperability across all Member States, connecting with national business registers, and supporting a wide range of trusted credentials all require serious technical work, something the WeBuild pilot has already helped highlight.

On top of that, the wallet needs to fit neatly within the wider regulatory landscape and be backed by strong security. It has to work smoothly with existing and upcoming rules, like the European Digital Identity framework and trust services legislation, while offering secure governance for legally binding actions like signing and sealing documents.

The challenges are real, but the proposal’s phased rollout, transition options, and strong focus on trust and security show a clear plan. If done well, the Business Wallet can become a key building block of a more harmonised, innovative, and digitally confident Single Market, benefiting both businesses and public authorities across Europe.

References

Press release: link.europa.eu/C7qtx8

Factsheet: link.europa.eu/gpHPbc

Q&A: link.europa.eu/VHmgG8

More: link.europa.eu/fmf4tN