Introduction

The current landscape of decentralised finance (DeFi) is evolving rapidly, yet most infrastructures still lack the regulatory compliance and transparency required for institutional participation. As traditional financial institutions require verifiable proof of compliance and identity before engaging onchain, PlatformD set out to build a regulated foundation for DeFi, one that embeds trust and verification at the protocol level. To achieve this, PlatformD partnered with cheqd, being confident that its decentralised identity infrastructure and verifiable credential technology could deliver the trustless, privacy-preserving compliance layer essential for the next generation of regulated financial applications.

PlatformD is an onchain securitisation engine. It is turning receivables into compliant and tradable digital securities, unlocking trillions of capital. It is part of the Bank of England and FCA’s Digital Securities Sandbox.

Challenges

PlatformD is pioneering the first Vertically Integrated Financial Application, embedding Financial Market Infrastructure for onchain securitisation. It transforms illiquid real-world assets, trade receivables, into programmable and tradable securities.

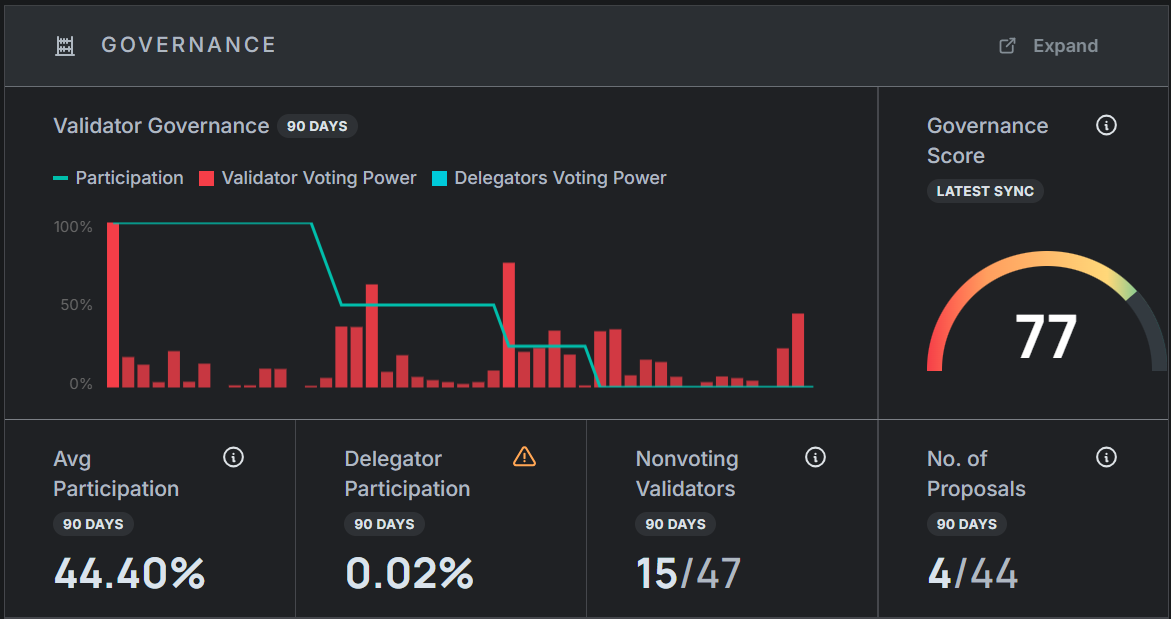

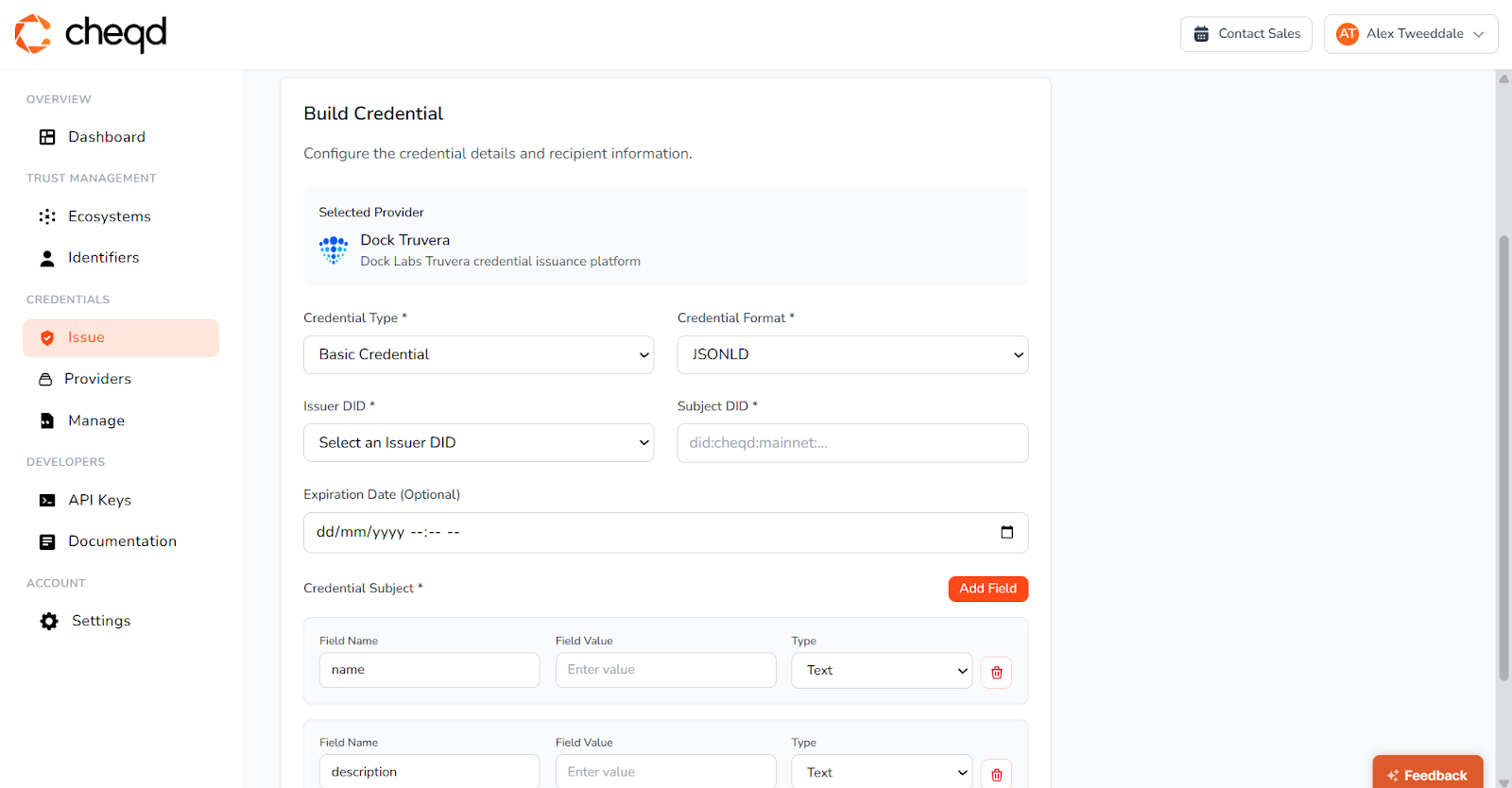

PlatformD is built on purpose-built Dchain, which requires institutional-grade compliance at both protocol and application levels. Every validator must present verifiable credentials proving regulatory compliance during consensus. PlatformD, deployed on Dchain, utilises onchain verifiers to create role-based access control (RBAC) for onchain programs.

To achieve this at scale, PlatformD needed infrastructure that could:

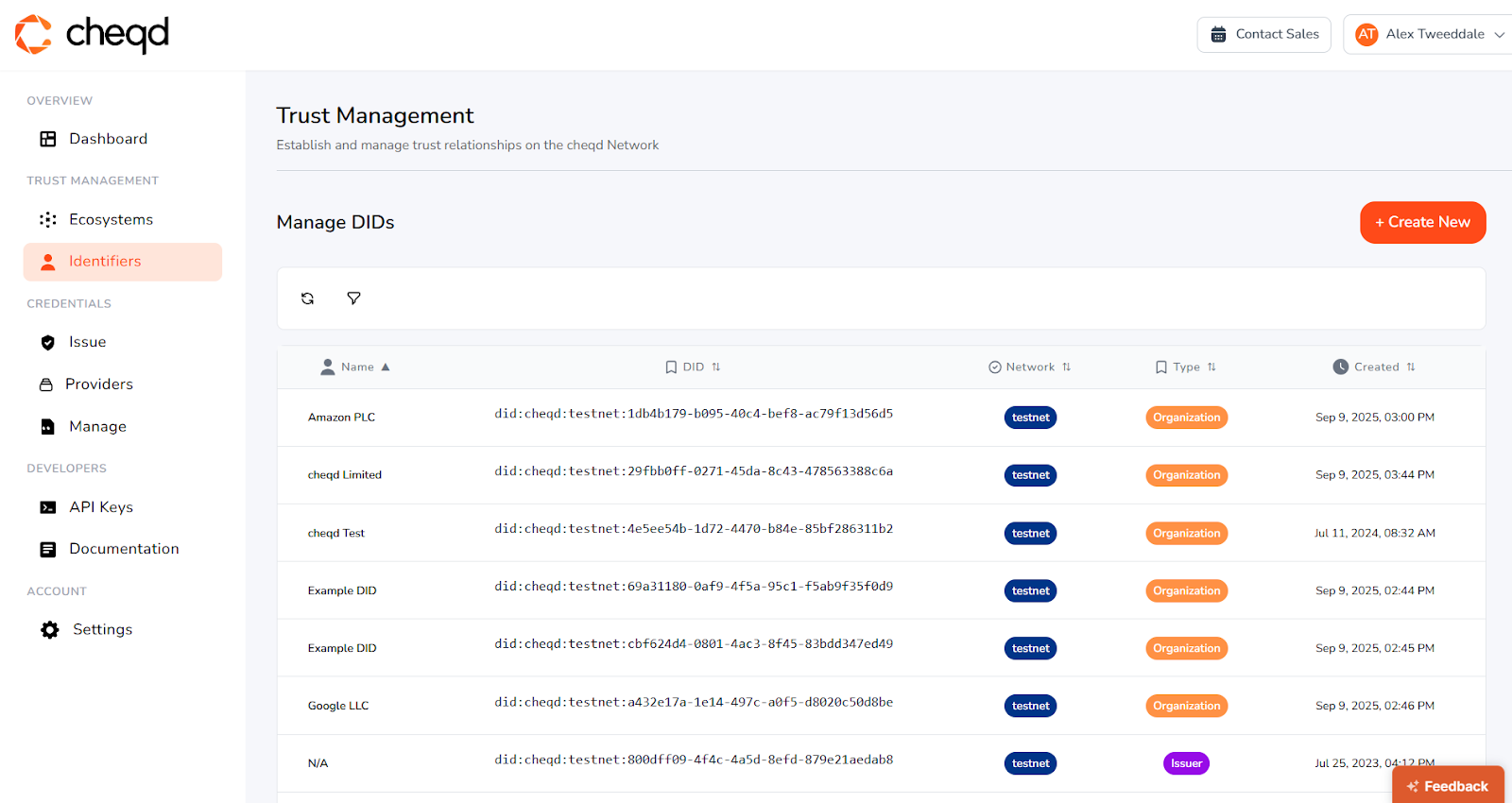

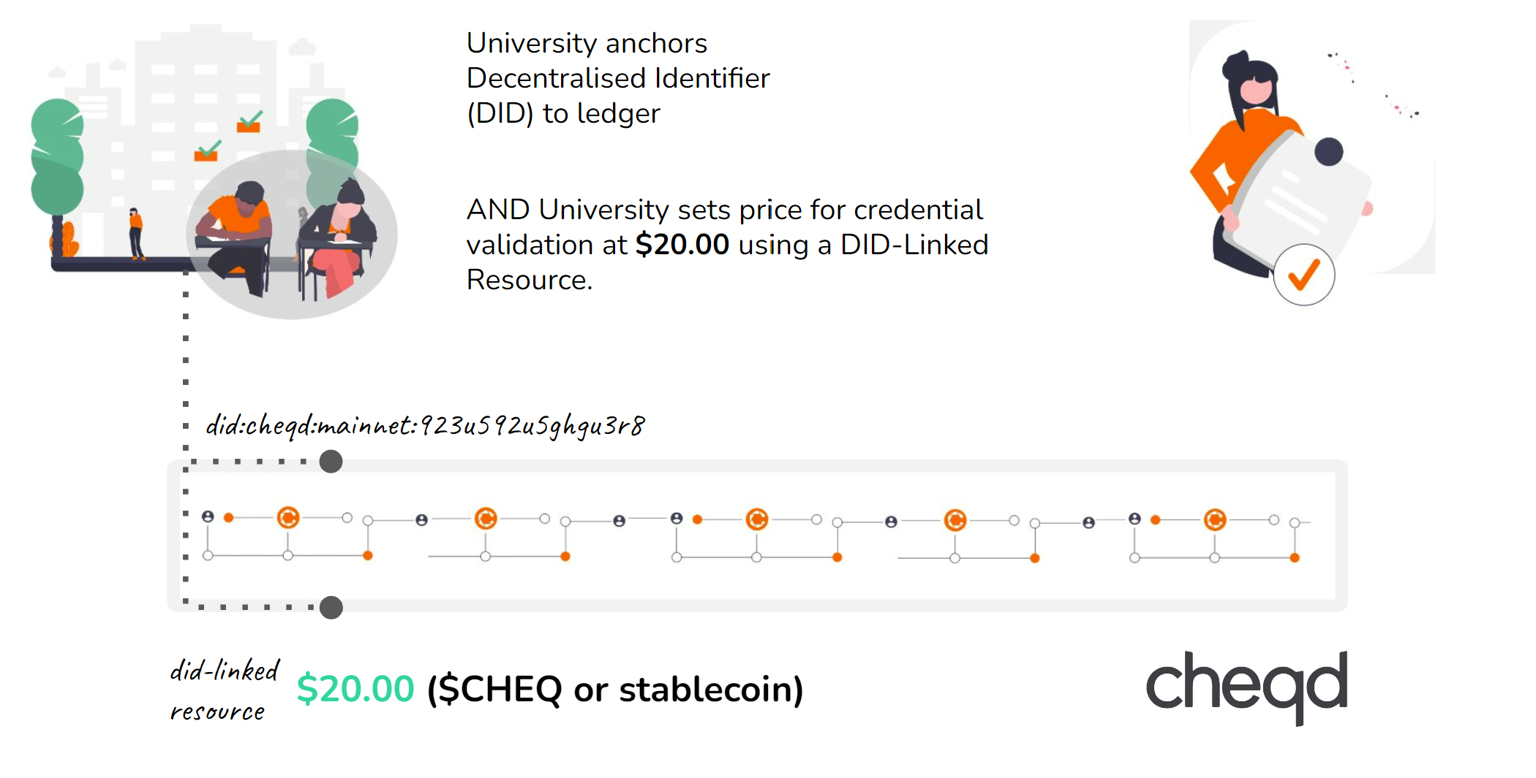

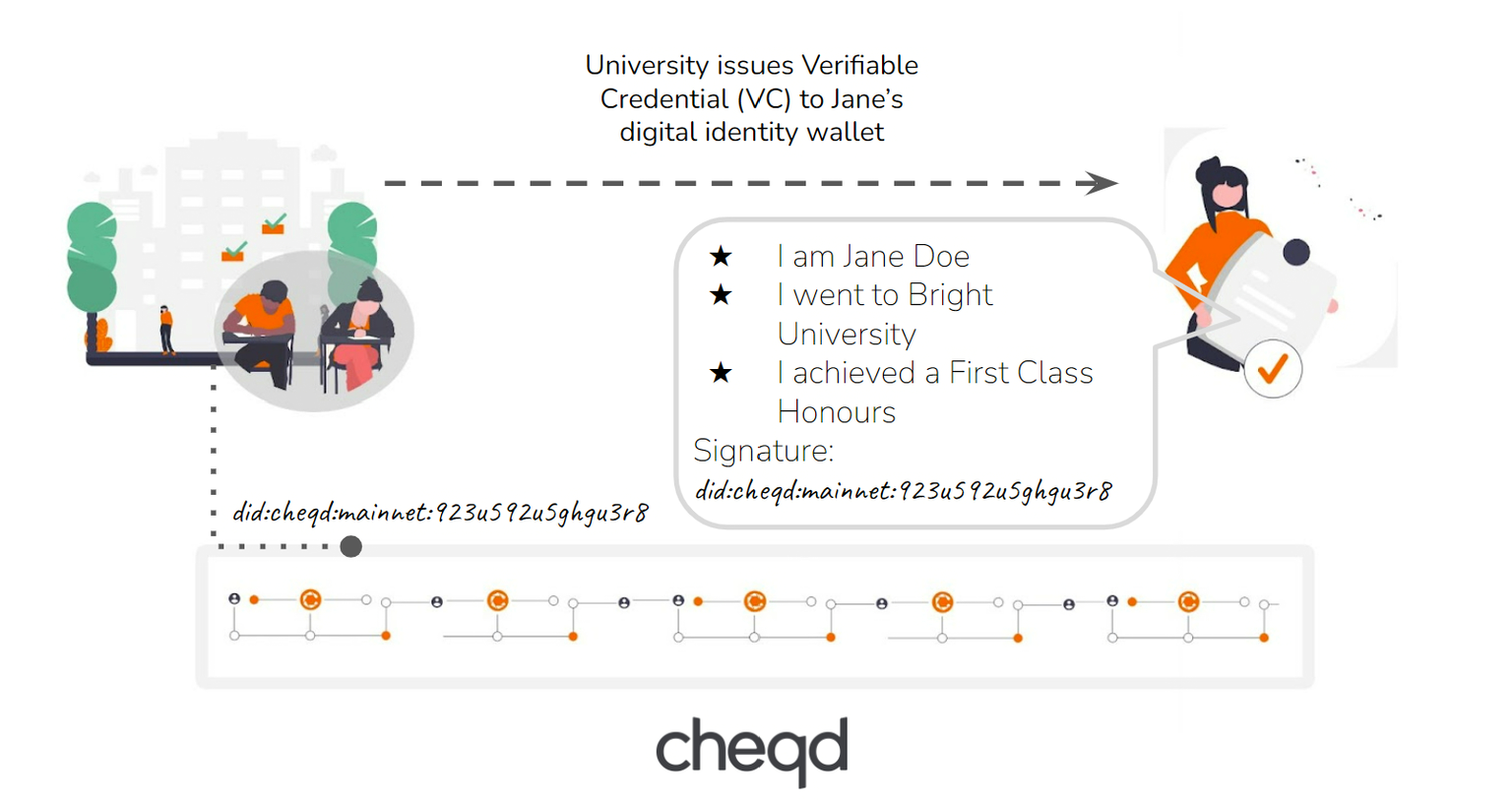

- Anchor decentralised identifiers (DIDs) and credential issuer information in a trustless manner

- Support modern, privacy-preserving credential standards (eIDAS 2.0 EAA)

- Integrate seamlessly with verifiable credentials issuance workflows

- Enable future cross-chain verifications

The Solution: Building a Trustless Compliance Layer

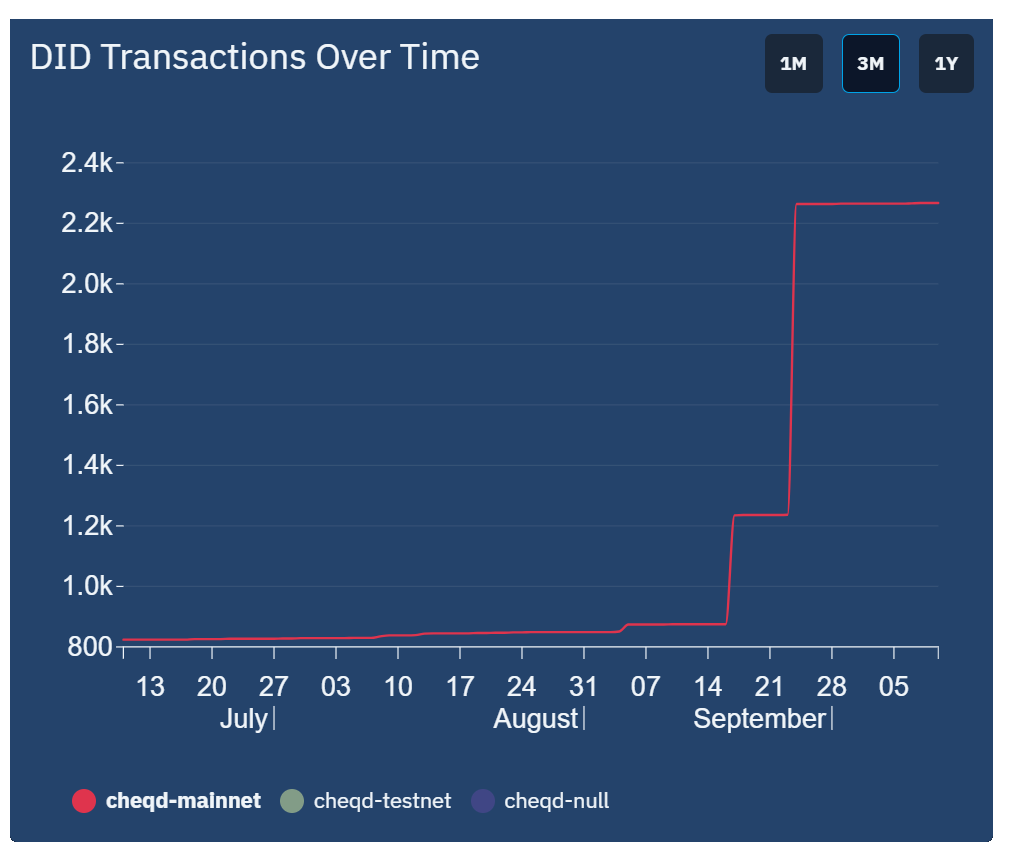

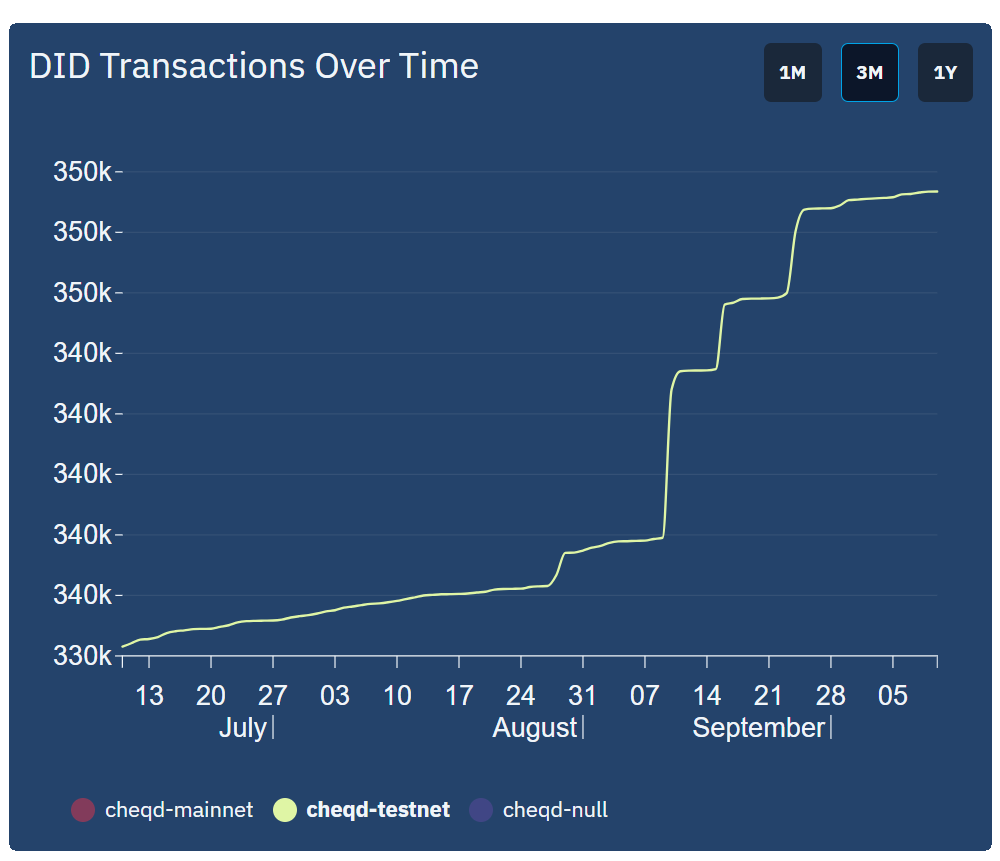

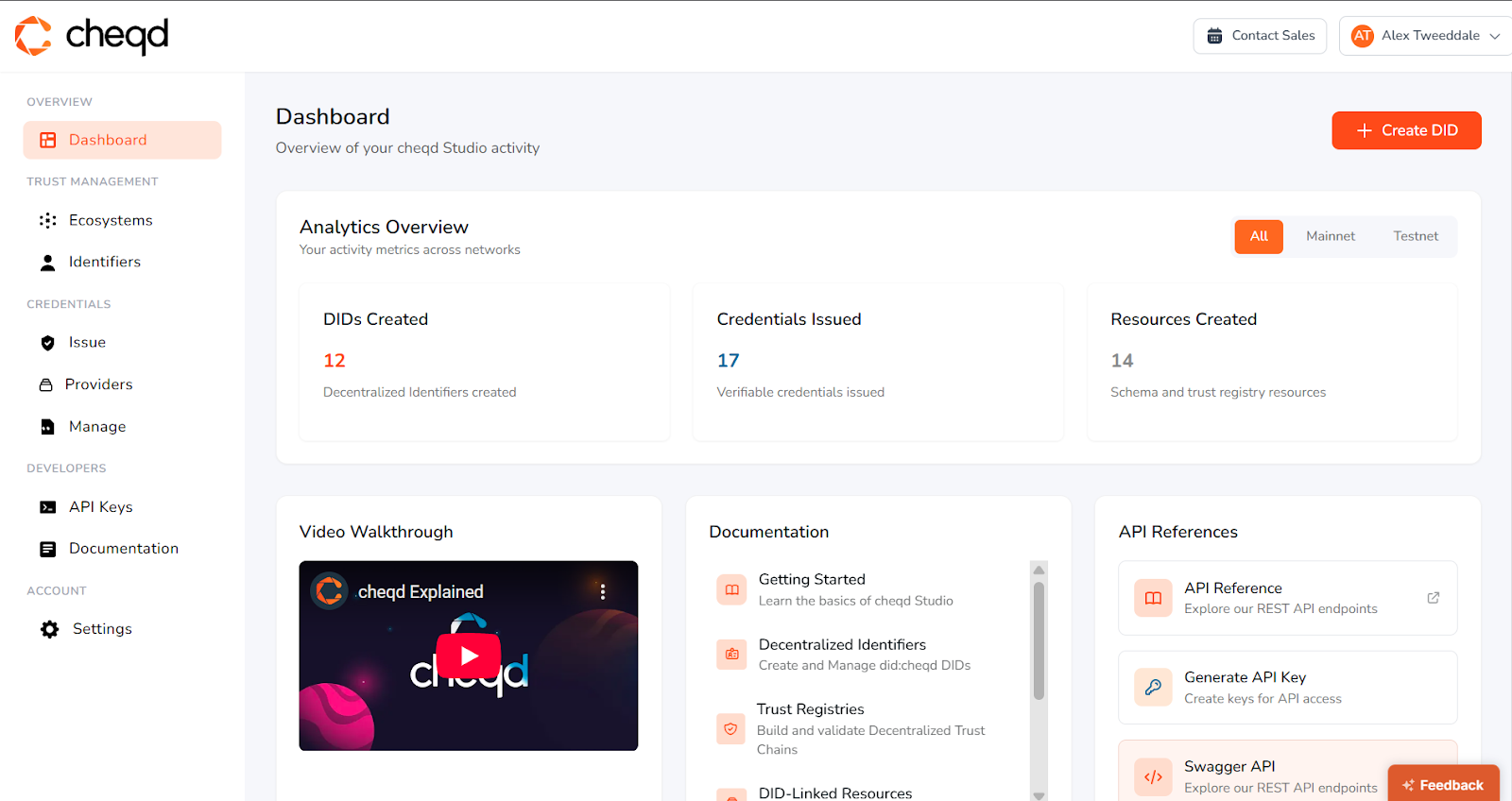

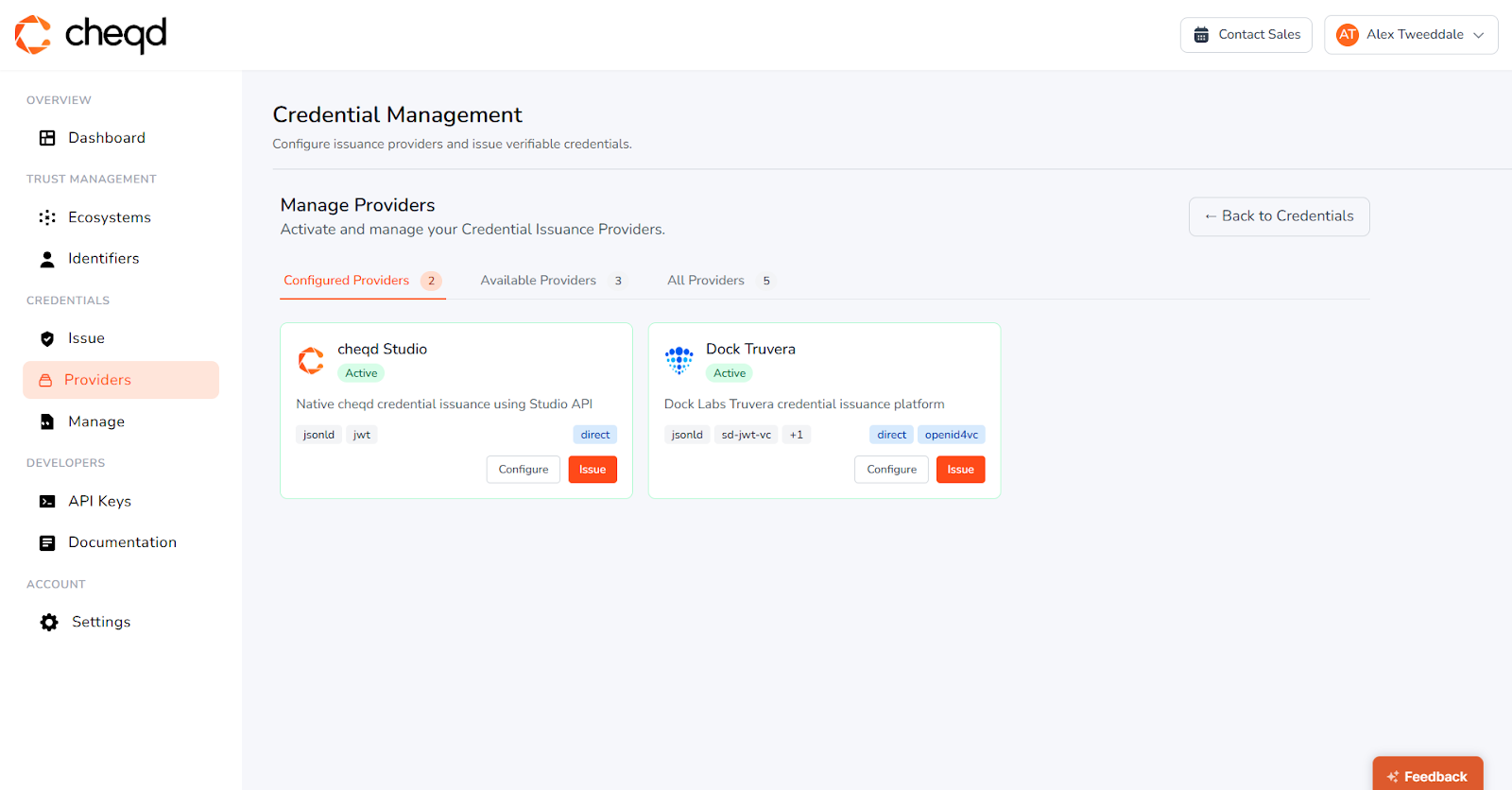

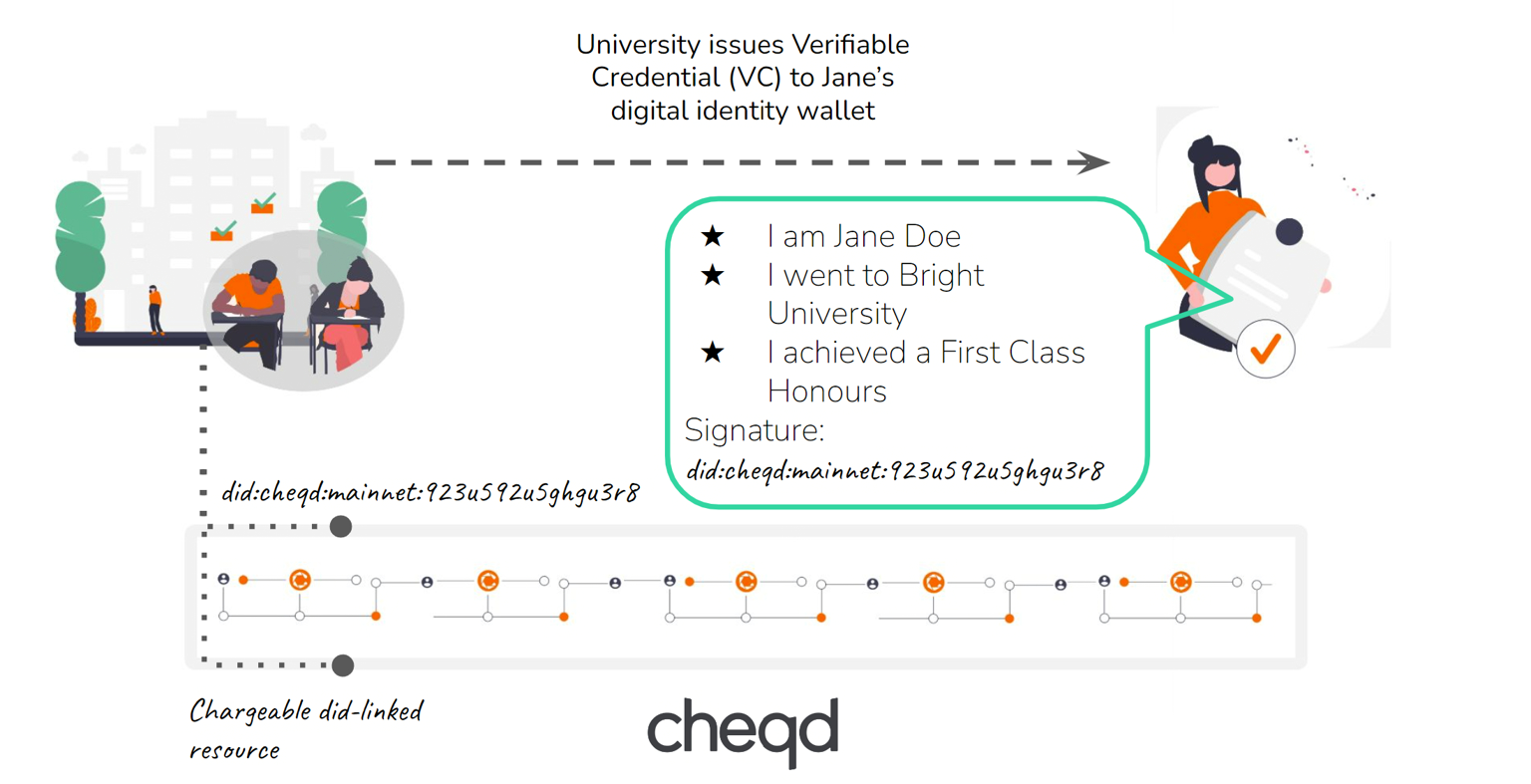

cheqd’s blockchain network provided the missing piece. During its Theodoric-I testnet, PlatformD integrated cheqd to anchor verifiable credential issuer information. This enabled transparent credential verification, allowing multiple trust service providers to issue verifiable credentials while avoiding a centralised address whitelisting approach.

Key technical implementations included:

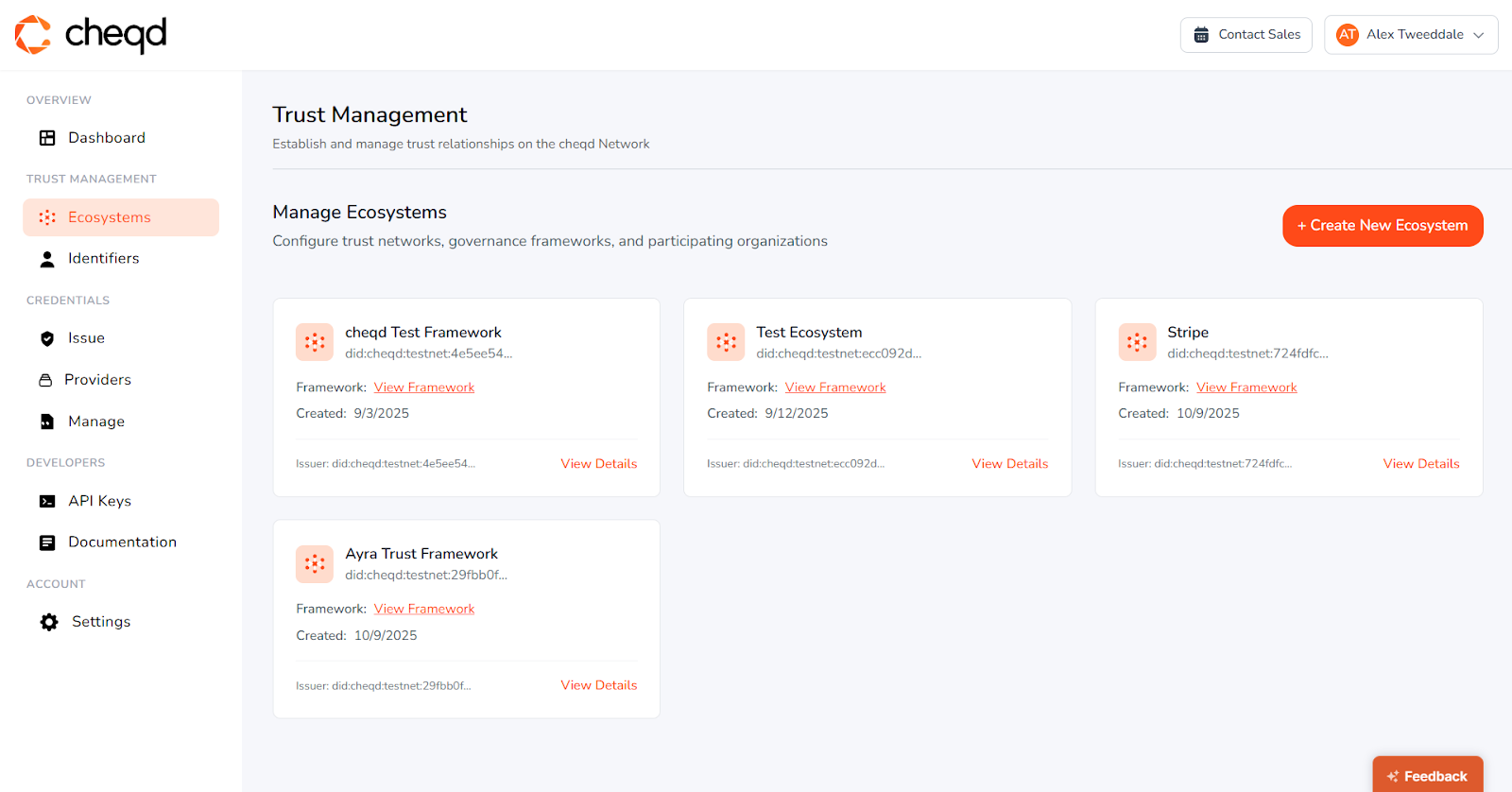

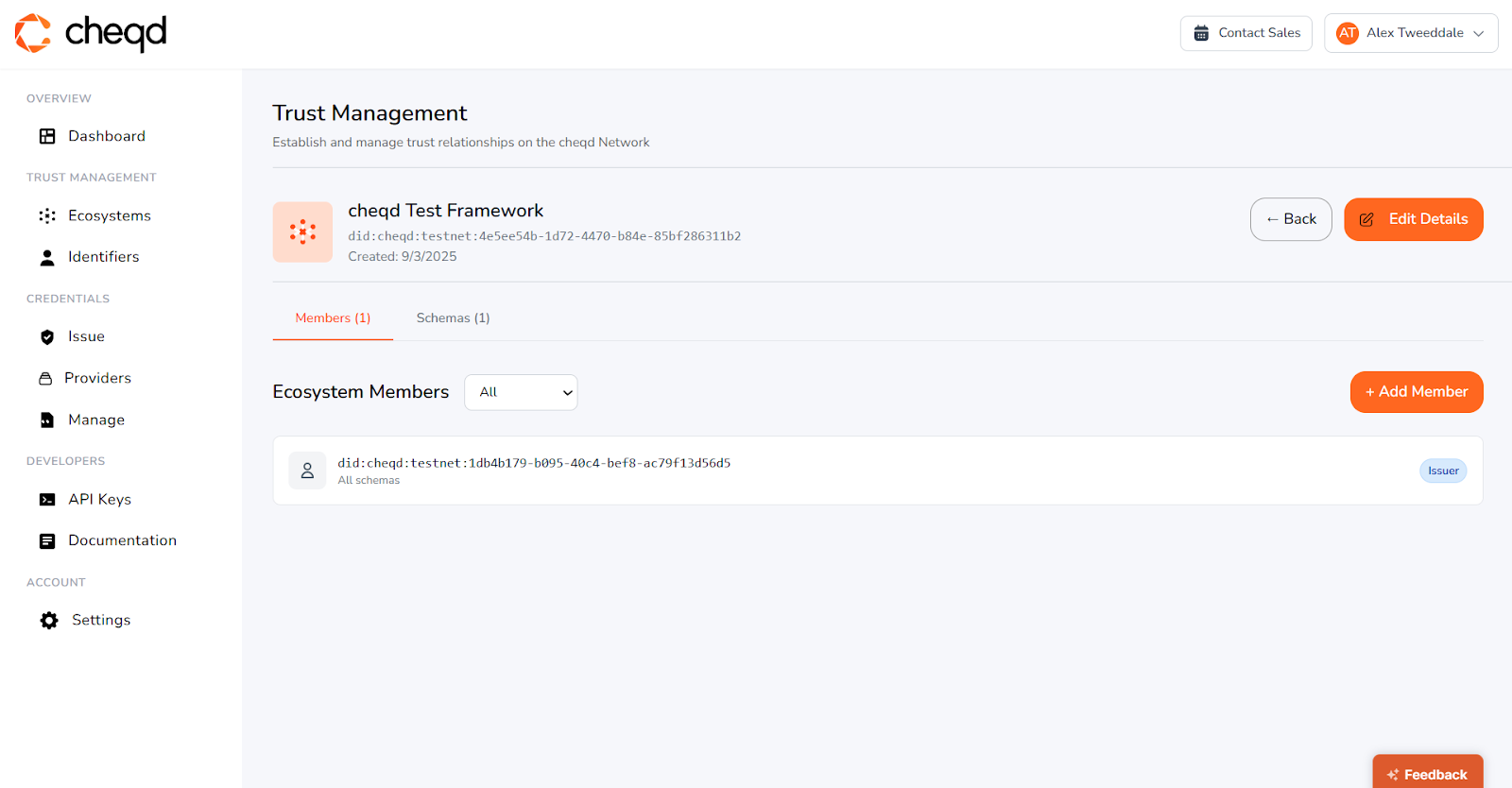

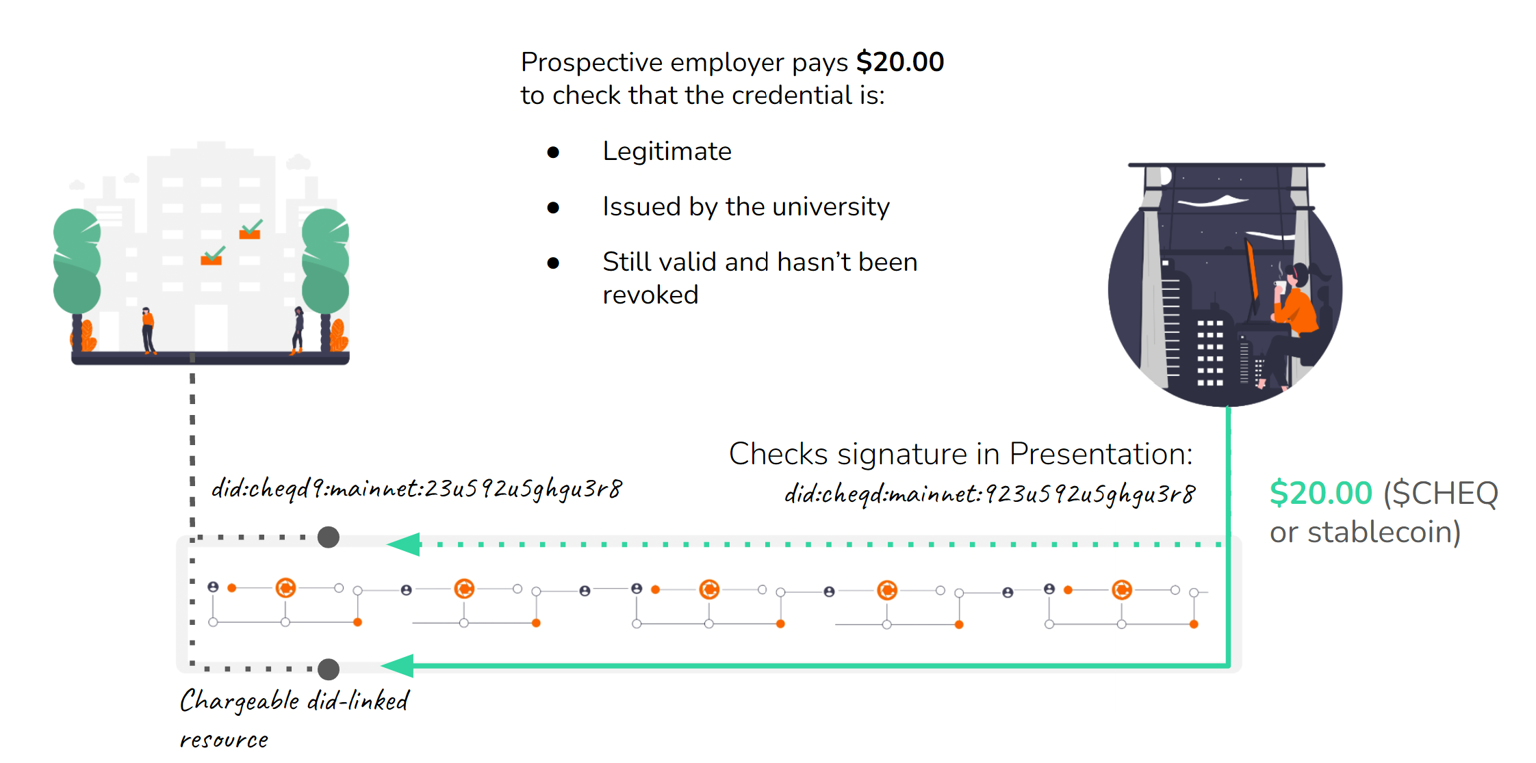

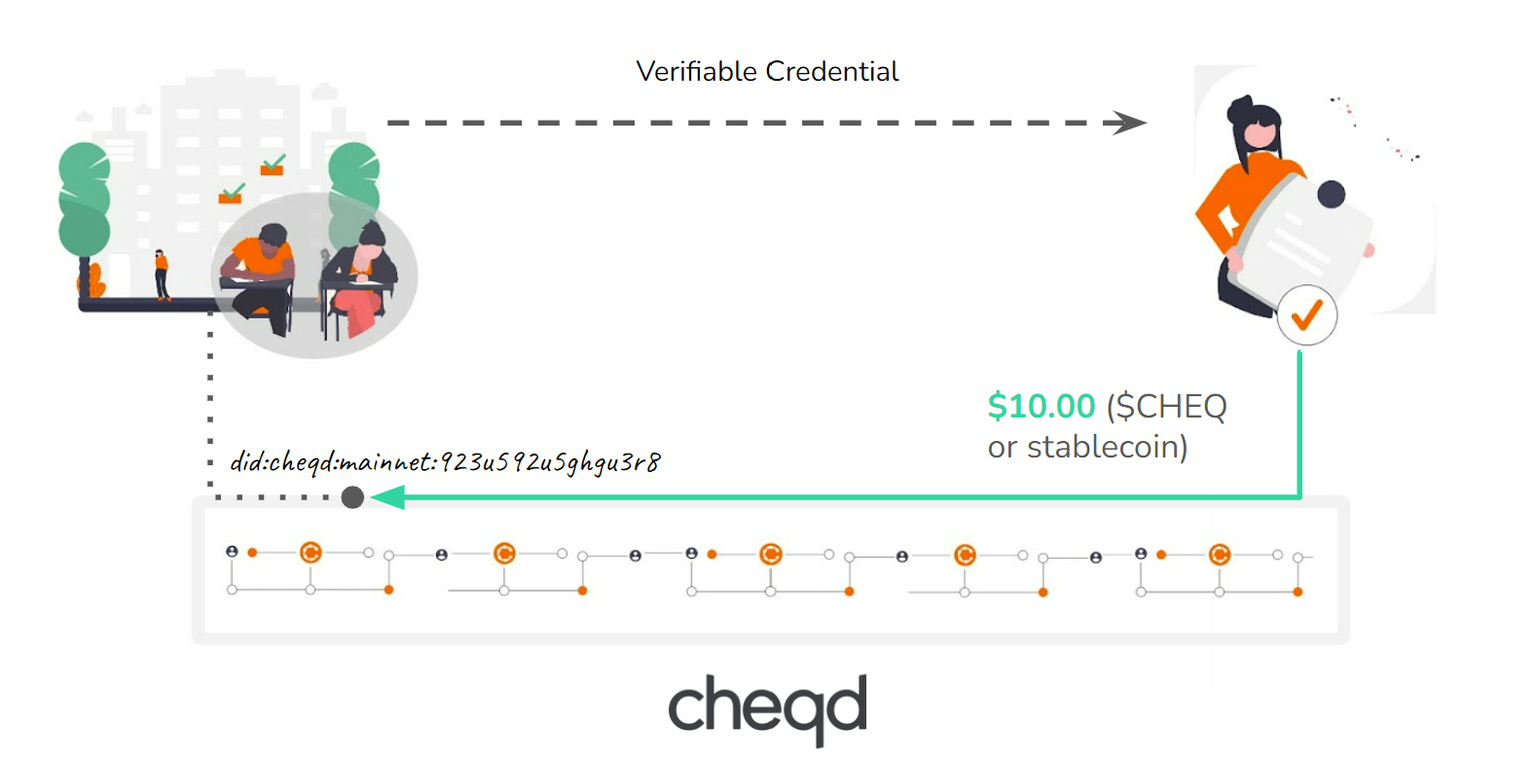

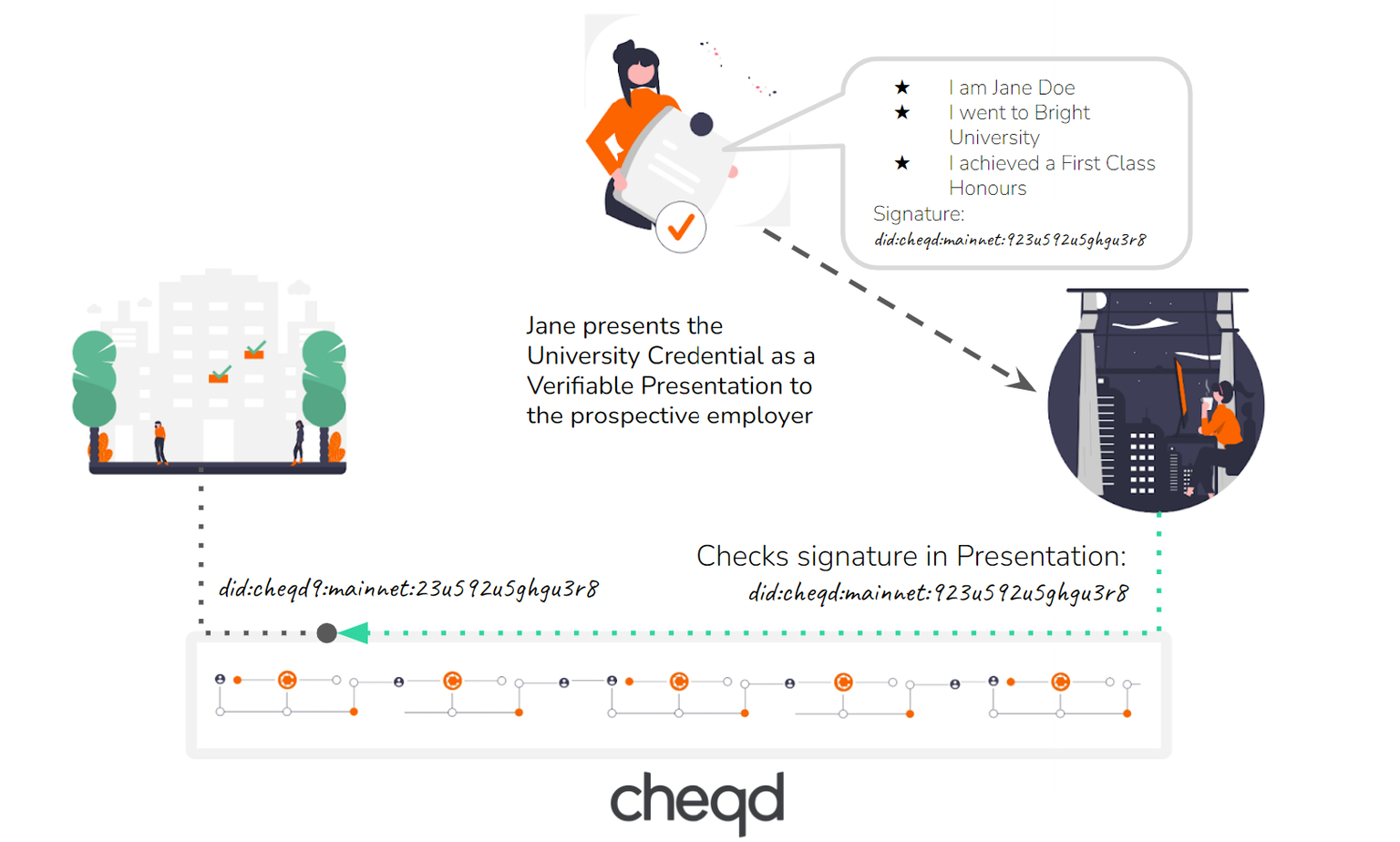

- Modern Trust Registry: cheqd’s infrastructure provided a contemporary trust registry solution. This allows Dchain governance to support multiple trust issuers with transparent verification — anyone can resolve the issuer’s DID to verify the privacy-preserving presentations. A solution that embeds compliance while remaining scalable and decentralisable.

- Trustless DID Resolution: For scalability, PlatformD leveraged cheqd’s IBC-enabled network to allow its verifier smart contract (AVIDA) to communicate directly with cheqd modules. This eliminated the need for trusted intermediaries, allowing future applications to fetch and verify issuer information in a completely decentralised way.

- Interoperability with Multiple Verifiable Credential Issuers: Partnering with Paradym.id, a cheqd ecosystem provider, gave PlatformD robust and developer-friendly tooling for credential issuance.

Outcomes and Impact

By integrating cheqd, PlatformD gained the capability to meet regulatory expectations for compliant and auditable network participation. cheqd provided the trust and verification layer that enabled PlatformD, through the Theodoric-I testnet, to demonstrate a regulatory pathway for DeFi within frameworks such as the FCA Digital Securities Sandbox, without introducing centralised control or compromising decentralisation.

- SSI-based real-time validator credential verification: Validators presented SD-JWT as part of their block proposal and voting data, allowing PlatformD to test revocation and issuer key rotation

- Automated revocation checks: ensuring no expired or invalid credentials participate in consensus

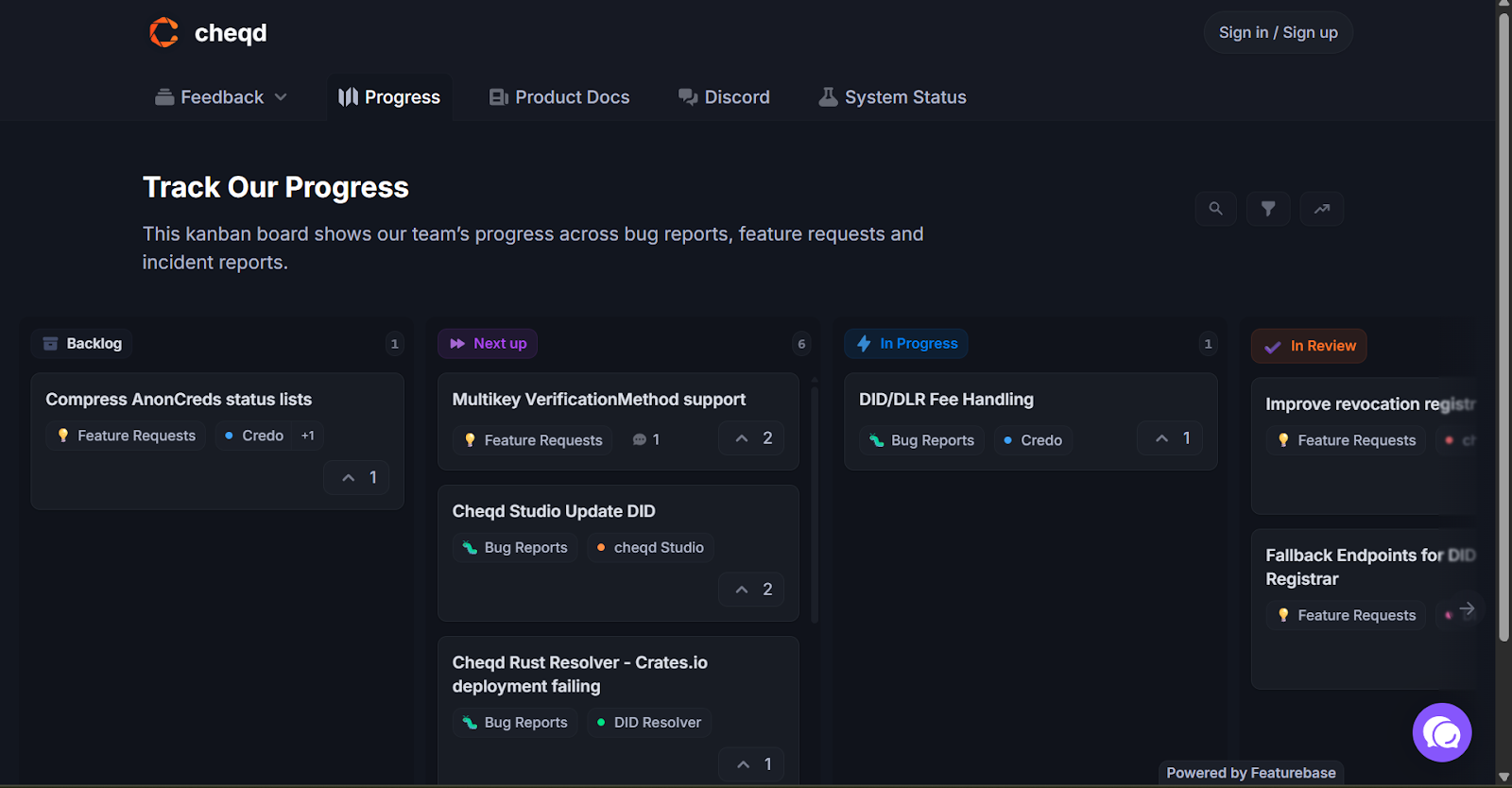

For a full recap, see: Recapping Theodoric-I: Dchain’s First Testnet

What the Founders Say

“PlatformD represents a major step toward bridging institutional finance and decentralised infrastructure. Their use of verifiable credentials at the protocol layer showcases how compliance and decentralisation can coexist without compromise. cheqd’s infrastructure provides the foundation for this. We enable trustless verification, decentralised issuer discovery, and interoperability across ecosystems, all whilst maintaining the privacy and scalability required for regulated DeFi.”

— Fraser Edwards, CEO and Co-founder of cheqd.

“Our decision to partner with cheqd stems from a deep alignment in both technology and vision. cheqd is a fully native project built on infrastructure we know intimately — pretty the same technology that underpins PlatformD’s Layer 1, Dchain. Their solid tokenomics and vibrant ecosystem of partners allow us to fully embrace the new paradigm of digital identity without compromising on architecture or decentralisation. Moreover, cheqd delivers credible, utility-driven innovation for one of the most critical components of verifiable credentials — revocation verification without correlation (‘no phone home’) — a capability that will be essential as this technology matures.”

— Egidio Casati, Co-CEO and Co-founder of Nymlab.

Conclusion

By leveraging cheqd’s trustless verification, DID anchoring, and verifiable credential capabilities, PlatformD has created a framework where institutional-grade compliance and decentralisation operate in harmony. As PlatformD prepares for Theodoric-II testnet, focused on asset notarisation with eIDAS 2.0 qualified electronic signatures, cheqd’s infrastructure continues to be a core utility ensuring trustless verification.

Reach out to cheqd at [email protected] to explore our trust and payment infrastructure.

Contact PlatformD at [email protected].