Disclaimer: All information provided is intended to help users get set up on cheqd. However, we do not expressly recommend or mandate a certain approach. All actions taken are your personal responsibility.

In our previous blog, we guided you through getting setup on Emeris to access Gravity DEX (using your Keplr wallet). In this one we’ll share some information on Osmosis, another DEX you might see us on soon.

What is Osmosis?

Osmosis is a Decentralised Exchange (DEX) on the Cosmos network. We covered the differences between DEXs and CEXs (Centralised Exchanges) in a previous piece.

It is the first major application of the Inter-Blockchain Communication Protocol protocol at scale (IBC covered here), and, aside from its brilliant UI and overall branding and imagery, its features are proving to be a powerful application and new entrant to the DeFi ecosystem.

Built using the Cosmos SDK, Osmosis is its own sovereign blockchain with its own token — OSMO — used for network staking and governance. What makes Osmosis so ground-breaking for the Cosmos ecosystem, and in fact, the broader decentralised ecosystem outside of Ethereum, is the way in which Osmosis acts as an automated market maker, made possible through its liquidity pools.

If you’re just getting started with crypto the following section is a little more complex. Feel free to skip this to where we explain how to get set up on Osmosis.

Understanding the origination of Automated Market Makers (AMMs) and Liquidity Pools

Here we’ll explain what they are and why they are needed in decentralised finance (DeFi) but first, like many things in the Web 3.0 and DeFi space, it’s important to understand the existing world of trade finance.

Traditional exchanges, i.e. Nasdaq, London Stock Exchange, STAR, work through an order book model which records the average of the current bid and ask prices being quoted. In this model buyers and sellers come together to trade; buyers simply try to buy at the lowest price possible, and sellers try to sell for the highest price.

For a trade to be completed both parties must agree on a fair price meaning either the buyer comes up or the seller goes down. However, it’s not that simple because finding someone who wants to both buy that specific amount and for the price they are looking to sell for is unlikely.

Let’s use an example.

Photograph: Shutterstock

You’ve just picked 100 apples on a farm but suddenly you have to leave town and need to sell every single one of them. You have to sell them at the market price of $1 in order to have enough to pay the farm their fee. You can’t find anyone willing to pay this price and you can’t take them with you. You’re stuck. This is where market makers come in handy.

In this example, the market maker would be an individual or company who is permanently on hand to purchase the apples at the market price of $1. When you place a market order to sell your apples, the market maker will buy them from you even if it doesn’t have a buyer lined up. Likewise, the reverse is also true; a buyer can purchase the apples even if a seller isn’t lined up.

Market makers in return earn a profit through the spread between the bid and offer price as they bear the risk of covering the apple which may drop below the market price. Without them, it would take considerably longer for buyers and sellers to be matched up, which in turn would reduce liquidity, making it more difficult to enter or exit positions (or leave town). They also track the current price of assets by changing their prices — hence they ‘make’ the market. This is the same method that Centralised Exchanges, such as Coinbase and Binance, work, however, it is not truly decentralised whilst you have a market maker acting as an intermediary to exchange.

That said, although it is valuable to buyers and sellers alike, as market makers perform this delicate balancing act, they command a disproportionate amount of power over the market and ultimately act as an intermediary… a big no in the decentralised vision.

Enter AMMs and liquidity pools

Where traditional finance requires expensive and centralised intermediaries which have a level of power to manipulate prices, AMMs allow digital assets to be traded in a permissionless and automatic way.

This both embodies the ideals of blockchain and decentralisation generally and offers users and companies unique opportunities to trade more efficiently and cheaply whilst having total trust in the system makes it so. Before they arrived on the scene, liquidity, i.e. how easy it is for one asset to be converted into another, often fiat currency without affecting its market price, was difficult for DEXs.

AMMs offer a solution to scarce liquidity through liquidity pools; a shared pot of tokens that users can trade against. Users can create a liquidity pool and others can supply tokens to it. In return, like with traditional market makers, those that are willing to take on the risk of providing liquidity to the pool earn fees and other rewards. An explanation specific to Osmosis can be found here. At the time of writing Osmosis’ liquidity pools contain about $544 million in total value locked (TVL).

Note: for the purpose of engaging with cheqd through its token the information above is not required, however, we strongly believe in the value of educating and sharing what we’re learning with our community to help you better understand DeFi and support us in raising the awareness of the shift to Web 3.0.

You get all that? Good… let’s get set up on Osmosis

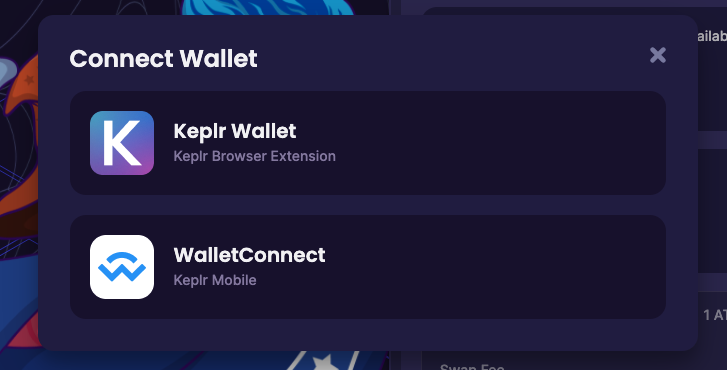

Head to Osmosis and click enter the lab. Once you’ve agreed to terms and you’re ‘in the lab’ you’ll see some trading pairs and a button to connect your wallet (bottom left of the dashboard).

You can then select Keplr wallet which will automatically connect to your Keplr wallet if you’ve already set it up as a Browser extension.

And you’re in. If you’ve already deposited to your Keplr wallet you’ll be able to start engaging start exploring pairing and liquidity pools — all at your own risk.

Enjoy your first walk around the lab….

Further reading/viewing:

- https://www.youtube.com/watch?v=82QP06QjkJY&t=93s

- https://www.youtube.com/watch?v=cizLhxSKrAc

- What Are Automated Market Makers?- https://www.gemini.com/cryptopedia/amm-what-are-automated-market-makers

- What is a Market Maker? — https://www.thebalance.com/what-is-a-market-maker-and-how-do-they-make-money-4053753

Get ready…

We’re extremely excited as our network launch is coming so very soon! And, we want to make sure that we reward our community. If you haven’t already joined our Telegram group, follow us on Twitter and sign up for a surprise.